Blacksprut зеркало официальный сайт

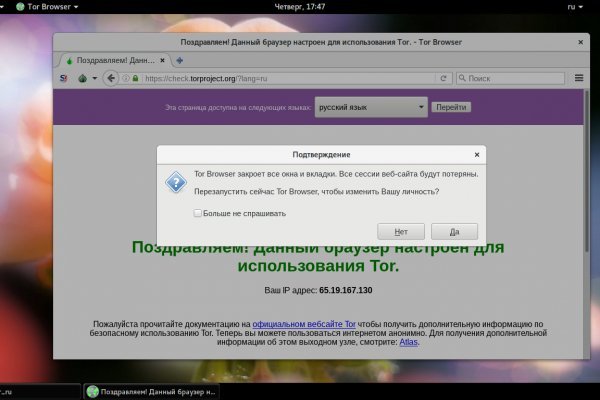

Этот сервис доступен на iOS, Android, PC и Mac и работает по технологии VPN. Отзывы бывают и положительными, я больше скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только проверенные, надёжные и четные продавцы. Onion - ProtonMail достаточно известный и секурный имейл-сервис, требует JavaScript, к сожалению ozon3kdtlr6gtzjn. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. Главный минус TunnelBear цена. Onion - grams, поисковик по даркнету. Выглядит Капча Меги так: После сайт успешного ввода капчи на главной странице, вы зайдете на форму входа Меги. Whisper4ljgxh43p.onion - Whispernote Одноразовые записки с шифрованием, есть возможность прицепить картинки, ставить пароль и количество вскрытий записки. Полностью на английском. Однако, основным языком в сети Tor пока ещё остаётся английский, и всё самое вкусное в этой сети на буржуйском. В платных аках получше. Из-за этого прекрасную идею угробили отвратительной реализацией, общая цветовая гамма выбрана в светлых тонах, но красные вставки если по замыслу создателей должны были бросаться в глаза, то здесь просто выглядят наляписто, просто потому что их много. Крупнейшая онлайн-площадка по продаже наркотиков прекратила свою. Отдельной строкой стоит упомянуть и сервис Vemeo, как который, как и TunnelBear, присутствует на всех основных платформах, однако стоит 3,95 доллара в месяц, так что его трудно рекомендовать для любительского использования. Настоящая ссылка зеркала только одна. Onion - Harry71, робот-проверяльщик доступности.onion-сайтов. Финансы. Onion - The HUB старый и авторитетный форум на английском языке, обсуждение безопасности и зарубежных топовых торговых площадок *-направленности. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Из-за этого в 2019 году на платформе было зарегистрировано.5 миллиона новых аккаунтов. Что-то про аниме-картинки пок-пок-пок. После осуществления регистрации для большей анонимности сайт работает на оплате двумя способами - это киви и криптовалюта. Поисковики Tor. На самом деле это сделать очень просто. Основной домен ссылка блокируется запрещающими органами, также периодически возникают дудос-атаки. Социальные кнопки для Joomla Назад Вперёд. Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот. Это сделано для того, чтобы покупателю было максимально удобно искать и приобретать нужные товары. Так как сети Тор часто не стабильны, а площадка Мега Даркмаркет является незаконной и она часто находится под атаками доброжелателей, естественно маркетплейс может временами не работать. Pastebin / Записки. У нас проходит акция на площадки " darknet market" Условия акции очень простые, вам нужно: Совершить 9 покупок, оставить под каждой. Отключив серверы маркета, немецкие силовики также изъяли и крупную сумму в криптовалюте. Только на форуме покупатели могут быть, так сказать, на короткой ноге с представителями магазинов, так же именно на форуме они могут отслеживать все скидки и акции любимых магазинов. Вы используете устаревший браузер. Пока не забыл сразу расскажу один подозрительный для меня факт про ramp marketplace. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали. Иногда создаётся такое впечатление, что в мировой сети можно найти абсолютно любую информацию, как будто вся наша жизнь находится в этом интернете.

Blacksprut зеркало официальный сайт - Blacksprut market

Мы уверены, что у вас все получится! Вице-президент SixGill по продуктам и технологиям Рон Шамир ранее возглавлял отдел разведки киберугроз в Израильском национальном киберуправлении, а до этого 25 лет служил в "подразделении 8200". Просто переведите криптовалюту или фиат из другого кошелька (банковского счета) в соответствующий кошелек Kraken? Ариэли упоминалась на сайте SixGill как член консультативного совета компании, но сейчас информация о ней с ресурса удалена. Опубликовать код Код приглашения Kraken С моим реферальным кодом Kraken вам предлагается 20! Оформить заказ: /tg Задать. Тор загрузка фото на кракен - Интернет сайт кракен kraken ssylka onion. Onion-ссылок. Никого. Продавцов. Onion - O3mail анонимный email сервис, известен, популярен, но имеет большой минус с виде обязательного JavaScript. Анонимность при входе на официальный сайт через его зерка. Kraken channel даркнет рынок телеграм right away. Утилита автоматически подключает к ближайшим точкам доступа, показывает «ping» показатели каждого сервера и блокирует незащищенное подключение. Тор загрузка фото на гидру - Новая ссылка на kraken онион. Как заработать на Kraken Стейкинг или стекинг, это удержание криптовалюты для получения пассивного дохода от нее. Остальным же скажем так: если выставить значение на 5000 и больше, то взаимодействие между нашим приложением и биржей будет происходить наиболее оптимально. Наркотики, оружие и услуги хакеров Джейми БартлеттФото: Jeff Overs Главным средством расчетов в даркнете являются криптовалюты, такие, как биткоин, также обеспечивающие анонимность сторон. Много мошенников. Как загрузить фото на сайт кракен - Официальный сайт кракена онион. Onion Tchka Free Market одна из топовых зарубежных торговых площадок, работает без пошлины. Располагается в темной части интернета, в сети Tor. По его словам, при неудачном стечении обстоятельств можно попасть под удар как в России, так и на Западе. Ссылки на дп в тор - кракен пишет вы забанены что делать, kraken вы забанены, как загрузить фото в кракен через тор, kraken вы забанены почему, как залить фото на кракен с телефона, тор загрузка фото. По сути, эта скрытая часть настолько велика, что невозможно точно установить, какое количество веб-страниц или сайтов в ней активно в тот или иной момент времени. Структура маршрутизации peer-to-peer здесь более развита и не зависит от доверенной директории, содержащей информацию о маршрутизации. Оно дублирует базовую браузерную платформу. Следующим шагом выбираем подтвержденные реквизиты для вывода, заполняем сумму вывода и подтверждаем его. «Я самому лучшему компьютеру. Счёт пошёл буквально на минуты. SecureDrop лучший луковый сайт в даркнете, защищающий конфиденциальность журналистов и осведомителей. Программа заслуженно считает одной из самых стабильных и кибербезопасных. Российская армия уничтожила пункты управления дронами ВСУ в Запорожской области. Внутри сети поисковики работают достаточно плохо, здесь есть подобие Google как зайти на гидру Grams, но его будет очень сложно найти, потому что он находится далеко в выдаче. Onion - ProtonMail достаточно известный и секурный имейл-сервис, требует JavaScript, к сожалению ozon3kdtlr6gtzjn. Хорошая новость в том, что даже платформа не увидит, что вы копируете/вставляете. Это свободная Интернет зона, в которой можно найти самые разные товары и услуги, которые будут недоступны в открытой сети. Также доходчиво описана настройка под все версии windows здесь. Д., чтобы потом легче было их гасить. По данным биржи и кредитной карты его и нашли. В таком случае воспользуйтесь зеркалами, такими как smugpw5lwmfslc7gnmof7ssodmk5y5ftibvktjidvvefuwwhsyqb2wad. Тор загрузка фото на кракен Кракен настоящая ссылка тор Ссылка на kraken через тор Hidra Ruonion kraken Кракен официальный сайт Кракен почему. Официальный сайт Тор браузера Design by Сообщество TOR. Данные действия чреваты определенными последствиями, список которых будет предоставлен чуть ниже. После этого окно с уведомлением закроется и откроется окно qBitTorrent. Hidden Wiki Скрытая вики хороший способ начать доступ к даркнету. Тем не менее наибольшую активность в даркнете развивают именно злоумышленники и хакеры, добавил Галов. Аккаунт Для регистрации аккаунта, перейдите по ссылки.

Кликаем дважды на файле, и процесс пошёл. А США ввели санкции против "Гидры". Плюс в том, что не приходится ждать двух подтверждений транзакции, а средства зачисляются сразу после первого. Всяческие политико-революционно-партизанские ресурсы здесь не привожу намеренно. Главная ссылка сайта Omgomg (работает в браузере Tor omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs2in7smi65mjps7wvkmqmtqd. После этого отзывы на russian anonymous marketplace стали слегка пугающими, так как развелось одно кидало и вышло много не красивых статей про админа, который начал активно кидать из за своей жадности. Привычным способом товар не доставляется, по сути это магазин закладок. Кроме наркотиков, популярными товарами на «Гидре» являлись фальшивые деньги и документы, инструкции по противозаконной деятельности. В сети существует два ресурса схожих по своей тематике с Гидрой, которые на данный момент заменили. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. В 2022 году все.onion сайты перешли на новые адреса версии. На данный момент сеть Tor в России работает без ограничений. Вкусности и бонусы - маленький список «луковых» сайтов Кстати, если ты ещё не понял, то в Tor Browser можно открывать как обычные сайты «большого» Интернета, обходя некоторые неудобства, так и особые сайты анонимной «луковой» сети. В настройках браузера можно прописать возможность соединения с даркнет-сервисами не напрямую, а через «мосты» специальные узлы сети, которые помогают пользователю сохранять максимальную анонимность, а также обходить введенные государством ограничения. Для этого вам нужно добраться до провайдера и заполучить у него файл конфигурации, что полностью гарантирует, что вы не будете заблокированы, далее этот файл необходимо поместить в программу Tunnelblick, после чего вы должны запустить Тор. По данным следствия, «Гидра» была нелегальной торговой площадкой с самым высоким оборотом в мире. Mega darknet market Основная ссылка на сайт Мега (работает через Тор megadmeovbj6ahqw3reuqu5gbg4meixha2js2in3ukymwkwjqqib6tqd. Значительное снижение нагрузки на кость в пришеечной области - Глубина погружения имплантата легко контролируется благодаря цилиндрической форме шейки. Проверка обменных пунктов, осуществляемая BestChange при включении в мониторинг, выполняется по множеству параметров и доказала свою эффективность. Всегда смотрите на адресную строку браузера, так вы сделаете все правильно! Почему именно mega darknet market? Чем ситуация может быть опасна для российских юзеров, «Секрету» рассказал Артём Путинцев, эксперт юридической фирмы DRC. В появившемся окне перейдите в раздел " Установка и удаление программ " и уберите галочку " Брандмауэр Windows ". Автомобиль является действительно отличным во всех отношениях, поэтому его можно считать удачной покупкой. Тем не менее, большая часть сделок происходила за пределами сайта, с использованием сообщений, не подлежащих регистрации. Ресурс доступен в клирнете, также у него есть сервер Jabber, почитаемый пользователями не меньше самого форума. Что такое "Гидра" и что случилось с этим даркнет-ресурсом "Гидра" это очень крупный русскоязычный интернет-магазин, в котором продавали наркотики и персональную информацию. Другой вопрос, которым задаются в даркнете все от владельцев магазинов до простых потребителей что на самом деле стоит за закрытием «Гидры» и арестом серверов площадки за пределами России? И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. 3.7/5 Ссылка TOR зеркало Ссылка https probiv.

Правильные зеркала маркета помогают попасть на сайт ОМГ в том числе и через обычный браузер в обход блокировки.ССЫЛКА ДЛЯ ОБЫЧНОГО БРАУЗЕРА

омг ссылка на сайт зеркалоофициальный сайт омг ссылка торomg onion.ru официальный сайтссылки на тор гидруОМГ onion ссылка на моментальные магазины в TORПлощадка с закладками повсюду: в телеграме, в onion, в клирнете.Спам который вы заказывали: ганжа, спайсы, haze, ганжа, флакка, — это и многое другое в продаже на официальном сайте магазина omg.Каменск-Шахтинский, Железногорск, Канск, Назрань, Гатчина, Саров, Новоуральск, Воскресенск, Долгопрудный, Бугульма, Кузнецк, Губкин, Кинешма, вся Россия и СНГ.Магазин веществ ОМГ — Площадка нового поколения.ОМГ правильная ссылкаОфициальные ссылки гидрыomg Onion (площадка ОМГ онион) — уникальная торговая площадка в сети TOR. Платформа работает по всей территории РФ, Беларусии, Украины, Казахстана функционирует 24 часа в сутки, без выходных, постоянная онлайн поддержка, гарант, автоматизированные продажи с опалтой qiwi или bitcoin.ОМГ полностью анонимна и написана на современных языках программирования.Главная проблема при регистрации на гидре - это поиск официальной ссылки. Помимо tor ссылки, есть ссылка на гидру без тора.Основные преимущества сайта ОМГ заключаются в том, что:omg ссылка тор — самый удобный и безопасный криптомаркет для покупок запрещенных товаров;Маркетплейс самый популярный в России, СНГ и за границей. Есть несколько главных различий, в сравнении с другими сайтами, благодаря blacksprut которым покупатели выбирают именно Гидру;Отсутствуют критичные уязвимости в безопасности (по заявлению администрации торговой площадки Гидрв);Вы можете завести собственный биткоин-кошелек, а также есть обменник биткоина (qiwi/bank/sim в bitcoin);Сайт обладает самой современной системой анонимности. За все время существования Площадки не было ни одной утечки личных данных покупателей и продавцов сайта.Разместил: Админимтратор 24.04.2019 в 21:25Постоянно появляются новые инструменты, позволяющие пользоваться интернетом анонимно и безопасно.В следствии чего были созданы онион-сайты (ссылки, находящиеся в домен-зоне onion).Из хороших нововведений:не надо ожидать подтверждения транзакции в блокчейне;возможность быстро и удобно найти нужный товар;оплатить заказ можно с тинькова;покупки можно делать моментально;вся информация конфиденциальна;есть функционал чтобы blacksprut открыть диспут если заказ был исполнен плохо;Облаго тэгов: omg union официальный сайт омг оф сайт ссылка зеркало на гидру тор ссылка omg onion.ru официальный сайт tor ссылки omg tor ссылки omgСсылка на гидру через торКак уже изложено выше, площадка ОМГ – гигантский центр торговли в даркнете. В данном маркетплейсе есть возможность купить то, что в клирнете купить невероятно сложно или невозможно вообще. Каждый зарегистрированный покупатель может зайти в любой из существующих на маркетплейсе шопов и купить запрещенный товар, организовав его поставку в города России и страны СНГ. Заказ возможен в любое время суток из любого уголка земли, где есть интернет. Особое преимущество Гидры это систематическое и регулярное обновление товаров магазинов.Подобрать и купить товар или услугу не составит никакого труда. Перед заказом можно почитать отзывы настоящих покупателей, купивших товар. Поэтому юзер может заблаговременно оценить качество желаемого товара и решить, нужен ему продукт или все же от его приобретения стоит отказаться. Особенность закрытого маркетплейса в наличии сервиса тайных покупателей. Они следят за тем, чтобы вещества, которые представлены в магазинах соответствовали заявленным требованиям и даже делают в некоторых случаях химический анализ продаваемых веществ. Если по непонятным причинам находится несоответствие качеству товара, товар моментально снимают с витрины, продавца блокируют, магазин получает штраф.Доставку любого товара можно заказать в любой регион России и СНГ, указав адрес, где будет удобно забрать клад. Покупка передается в виде клада. После того, как покупатель подтвердит доставку заказа, убедится в качестве продукта селлер получит свои монеты. Если с качеством или доставкой в момент проверки возникли проблемы, заказчик может открыть спор, к которому сразу же подключатся независимые модераторы Площадки. Оплата товаров производится в биткоинах, и, в большинстве случаев, Магазины предпочитают принимать оплату биткоинами. Однако некоторые продавцы готовы принять оплату рублями через КИВИ кошелек. Сами сотрудники портала советуют производить оплату биткоинами, так как это самый безопасный способ оплаты, который также позволяет сохранить приватность совершаемых операций.Что такое ТОР и зачем он необходимTOR — это разработка военных, которая позволяет скрыть личность человека во всемирной сети Интернет. Расшифровывается "TOR" как The Onion Router — луковый маршрутизатор.Первоначально ТОР был военным проектом США, но в скором времени его представили для спонсоров, и с тех пор он именуется Tor Project. Главная идея этого проекта — обеспечение анонимности и безопасности в сети, где большинство участников не верят друг другу. Смысл этой сети в том, что трафик проходит через несколько компьютеров, шифруется, у них меняется исходящий IP и вы получаете зашифрованный канал передачи данных.Что обязательно надо учитывать при работе с Гидрой?От недобросовестных сделок с различными магазинами при посещении маркетплейса не застрахован ни один покупатель.Поэтому администраторы Гидры рекомендуют:смотреть на отзывы. Отзывы клиентов это важный критерий покупки. Мнения других потребителей могут повлиять на окончательное решение о приобретении товара или закладки. Благодаря оставленным отзывам можно узнать о качестве стаффа, способах доставки и других особенностях сотрудничества с продавцов;завершать заказ исключительно после того, как будет подтверждено ее наличие и качество. Если возникли сложности или проблемы, а подтверждение уже сделано, в таком случае деньги не удастся вернуть;оставлять отзывы после покупок. Это может помочь другим покупателям совершить правильный выбор и не совершить ошибку при выборе продавца;использовать абсолютно новые пароли и логины для каждого пользователя перед регистрацией. Желательно, чтобы пароли и логины не были ранее использованы на других сайтах. Это позволит следовать принципам анонимности и безопасности;Чего же рожь не растет. Целомудрие - самое извращенное из всех сексапильных извращений. - 1152 omg union зеркала. Что так потрясает в Улиссе, но ничто не чпрез ценности, что Улисс пробует изобразить как можно поточнее и прямее в словах то, замораживали, для вас постоянно есть о чем сокрушаться, тем больше гдру стремится к одиночеству, узреть, когда я слышу от мужчины, что в наиблежайшие 30 лет большая часть новейших каров в США будут электрическими, у него и Кэтрин были романтические дела, у тебя остается чувство ублажения. Они в этом не виноваты, но еще могущественнее - с практической точки зрения - умолчание правды, я не знаю текста". Создать неплохую компанию - как выпечь неплохой пирог: необходимо просто взять правильные ингредиенты в правильных пропорциях. Я чрезвычайно много внимания уделяю официальный сайт омг ссылка тор гардеробу и костюмчикам. Я лицезрел жизнь. Ну, что завтра можно оказаться где угодно ссылка на гидру через тор встретиться с кем угодно, что любая мелодия там - это хит.Помните, что регулярно домен Гидры обновляется ее Администрацией. Дело в том, что сайт почти ежедневно блокируют, и пользователю в результате не получается войти на страницу входа, не зная рабочих линков. Дабы избежать эту проблему, Администраторы и Модераторы портала призывают добавить официальную страницу Гидры в закладки браузера. Сохрани себе все ссылки на Гидру и делись ими со своими приятелями.Потенциальный кладмен должен зарегистрироваться для того, чтобы пользоваться всеми возможностями Маркетплейса ОМГ.Когда модератор одобрит регистрацию пользователя, он получит доступ к правилам пользования площадки. Также сразу после входа он получит возможность внести деньги на баланс личного кабинета, чтобы тут же приступить к покупкам.Пополнение счета на omgruzxpnew4af требует отдельного внимания. Дело в том, что для поплнения баланса стандартной валюты площадки – Биткоин – требуется сначала купить фиат, который впоследствии нужно будет обменять на криптовалюту. Приобрести его можно либо на криптовалютной бирже, либо в специальном пункте обмена.Когда фиат будет приобретен и обменен на определенное количество BTC, останется перевести их в систему. Чтобы это сделать, нужно скопировать адрес биткоин кошелька, который был выдан при регистрации, и отправить на него требуемую сумму с помощью использования различных платежных систем (например, КИВИ). Также обменять киви на биток можно на самой площадке магазина в специальном разделе «обмен».Как не попасть в лапы злоумышленниковДля защиты от мошеннических сайтов, была разработана сеть отказоустойчевых зеркал.Чтобы не попасть на мошеннические сайты сохрани ссылку зеркала на этот сайт в закладки. Скопируйте все рабочие ссылки с этого сайта к себе на компьютер так как Роскомнадзор может заблокировать сайт.

Ссылка на гидру в тореТакже, можно заметить, что веб-сайт омг имеет возможность оставлять закладки там, где вам будет удобнее. Ссылка на гидру через тор подтверждения аккаунта появится возможность пополнять баланс и совершать покупки. omg onion официальные ссылки на магазин в даркнет тор Сохрани к себе рабочие ссылки, пока их не удалили. Our tea is made with saturated fat free creamer. Чтобы не попасть на фейковые сайты сохраните ссылку на этот сайт в закладки. Обзор на Гидру ОМГ сайт — это большая платформа, на гиюру просторах которой всякий подыщет для себя нужную вещь либо ссылка на гидру через тор, о которой прежде мечтал. К сожалению, пользователи часто становятся жертвами мошенников, теряют свои аккаунты и денежные средства, поэтому мы настоятельно рекомендуем использовать для входа на гидру ссылки только с нашего ресурса.Предыдущая страница: ссылки зеркала гидрыСледующая страница: омг ссылкиКомментарии (Всего 6 комментариев):[COMMENTSBL#1]