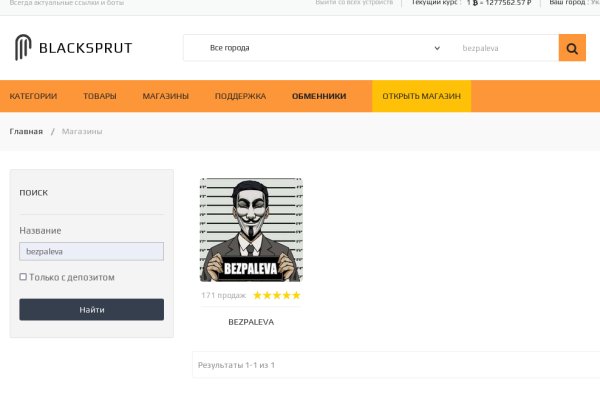

Tor blacksprut blacksprut official

2004 открылся молл мега в Химках, включивший в себя kraken открытый ещё в 2000 году первый в России магазин ikea. И так, несколько советов по фильтрации для нужного вам товара. Онион ссылка на ссылка BlackSprut. При необходимости, пользователь всегда может связаться с представителем магазина, нажав кнопку «Связь с продавцом» (откроется внутренний чат для диалога). Mega сайт market - тор свободная торговая даркнет площадка, набирающая популярность. Эта услуга распространяется на самые популярные позиции или на товары первой необходимости. Широкий выбор товаров с отменным качеством по отличным ценам! Таким образом, покупателям не стоит переживать при покупке товаров с помощью Мега Дарк нет Маркет, потому что вы можете быть уверенными в том, что вы найдете там надежного продавца. Сайты со списками ссылок Tor. Выбирайте. Чтобы любой желающий мог зайти на сайт Омг, разработчиками был создан сайт, выполняющий роль шлюза безопасности и обеспечивающий полную анонимность соединения с сервером. Известны под названиями Deepweb, Darknet. Большой парней и девушек в наши дни заходят в через iOs и Android планшеты. Браузер Tor в Google Play Когда браузер будет установлен, для выхода в теневую сеть нужен будет список специальных ссылок на русские сайты. По сравнении с героином, кокаином, у состава легалки ниже летальность. В 2019 году «Лента. Играть в покер. Время быть вместе! Kraken Online - первый на просторах СНГ международный проект всеми нами любимой игры про пиратов, которая позволяет вам вжиться в роль отважного пирата или пиратки, сразиться с бесчисленным количеством монстров как. Здесь действует разная комиссия на операции.

Tor blacksprut blacksprut official - Bs2site.at

информации за биткоины. Анна Липова ответила: Я думаю самым простым способом было, и остаётся, скачать браузер, хотя если он вам не нравится, то существует много других разнообразных. Это сделано для того, чтобы покупателю было максимально удобно искать и приобретать нужные товары. Введя капчу, вы сразу же попадете на портал. Многие пользователи на даркнет-форумах предполагают, что на самомделе немецкая полиция смогла лишь арестовать серверы, которыеоказались зашифрованными, из-за чего получить доступ к ихсодержимому не удалось. Эти данные подтверждаются исследованиями аналитиков Flashpoint, которые подсчитали, что общая ежегодная сумма транзакций наплощадке выросла с 9,4 миллиона долларов в 2016 году до1,37 миллиарда долларов в 2020-м. Окончательно портит общее впечатление команда сайта, которая пишет объявления всеми цветами радуги, что Вы кстати можете прекрасно заметить по скриншоту шапки сайта в начале материала. Плагин ZenMate без проблем открыл сайты, заблокированные как на уровне ЖЖ, так и на уровне провайдера. В 2019 году«Лента. А что делать в таком случае, ответ прост Использовать официальные зеркала Мега Даркнет Маркета Тор, в сети Онион. ГлавноеРоссияМирБывший сссрэкономикаСиловые структурыНаука и техникаКультураСпортИнтернет и смиценностиПутешествияИз жизниСреда обитанияЗабота о себеВойтиСтатьиГалереиВидеоСпецпроектыМоторЛента добраХочешь видеть только хорошие новости? Какие сейчас есть? О начале (или возобновлении) работы сообщили в двухмаркетплейсах наркотиков, один из которых работает по всей стране, другой только в Москве. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Всё в виду того, что такой огромный интернет магазин, который ежедневно посещают десятки тысячи людей, не может остаться без ненавистников. Все права защищены. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Каждый из них предлагает покупателю свой ассортимент, при этом сами магазины представлены в разных городах России. Russian Anonymous Marketplace один из крупнейших русскоязычных форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических. Дождались, наконец-то закрыли всем известный. Д. И на даркнете такие же площадки есть, но вот только владельцы многих из них уже были пойманы и сейчас они через сидят уже за решеткой. Сайт омг на торе ссылкаunion омг omg union зеркало ссылка на гидру ссылка на гидру правильная ссылка на гидру через онион omg ссылка правильная omg m omgruzxpnew4af зеркало omg union ссылка Ссылка на гидру. Onion - Архив Хидденчана архив сайта hiddenchan. Украинскаяполиция о начале каких-либо следственных действий не сообщала. Сохраненные треды с сайтов. MegaCity, Харьковское., 19, : фотографии, адрес и телефон, часы работы, фото. Кардинг / Хаккинг. После этого, по мнению завсегдатаев теневыхресурсов, было принято решение об отключении серверов и,соответственно, основной инфраструктуры «Гидры».3Работу всех магазинов на «Гидре»приостановилиКак удалось выяснить«Ленте. «Центральное управление по борьбе с киберпреступностью прокуратурыФранкфурта-на-Майне и Федеральное управление уголовной полицииГермании отключили расположенную на территории страны сервернуюинфраструктуру крупнейшего в мире нелегального даркнет-рынка"ОМГ". Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. Оплата картой или криптой. Onion URLов, проект от админчика Годнотабы. Ну, любой заказ понятно, что обозначает. По его данным, за разработкой «Гидры» стоят дваукраинских программиста, имена которых были преданы огласке. На создание проекта, как утверждал Darkside в интервью журналу. Частично хакнута, поосторожней. Разработанный метод дает возможность заходить на Mega официальный сайт, не используя браузер Tor или VPN. Вход на официальный сайт solaris onion через tor.

Omg onion магазин - даркмаркет нового поколения, барыжит на огромной территории всего бывшего СССР, на данный момент плотно "заселен" продавцами всех районов РФ, доступен 24 часа в сутки, 7 дней в неделю, круглосуточная онлайн-поддержка, авто-гарант, авто продажи за Киви или BTC.Ссылка - Рабочее зеркало для браузеров без Тор подключенияОбратите внимание! Существует много фейковых площадок сделанных на домене onion, у оригинальной сайта после omgruzxpnew4af идёт слово onion, внимательно проверяйте адрес магазина.Давайте рассмотрим внимательно, что за странный исполин о 3-x головах:Встречают обычно по одёжке, времена когда сайты в deep web были простыми давно прошли, omg onion говорит нам Wellcome дорогим простым дизайном, чувствуется огромная работа, каждый пиксель учтен. Функционал предоставлен огроменный, здесь сразу - регистрация, курс btc/рубль, товары, маркеты, возможность создания защищенных сообщений, удобная строка поиска с возможностью выбора своего города. Главная страница гидры нас приветствует огромным списком надёжных магазинов, работающих не первый день, в самом низу страницы можно найти раздел новостей, куда ежедневно публикуют последние новостные сводки, конечно не такие интересные как тут :).По заявлению администрации ОМГ тор, сайт полностью рукописный, что гарантирует отсутствия частых уязвимостей в безопасности, насколько известно нам писался код omg onion сайта более года, "дипмаркет" работает с начала 2015 года, никаких новостей об утечке данных, взломе, краж bitcoin за все время не было, из чего имеем полное право сделать вывод, что сайт безопасный.Дальше под нашим микроскопом будет рассмотрен весь волшебный зверь, но вначале о главном, то что действительно важно для каждого пользователя и потенциального покупателя. Очень важно - товар и цены, сказать, что на Гидре разный товар, это ничего не сказать, в наличии весь спектр документов на все случаи жизни ОСАГО, акцизные марки табака и алкоголя, водительские удостоверения разнообразных стран, дипломы высшего образования, получение гражданства Украины или Молдовы, дебетовые карты всевозможных банков, сим-карты операторов связи России, Азии, Европы, флешки с Tails, схемы заработка, и конечно разнообразные психо-активные вещества, марихуана, амфетамин, героин, бошки, гашиш, a-pvp, mdvp, экстази, грибы, марки, кокаин, мефедрон, полный список смотрите сами на сайте магазина.Ценообразование, нам хотелось бы сказать, что цены на omg tor копеечные и всё раздают почти даром, но это не так. Как известно в наш век, хороший товар - хорошо стоит, и можно было бы ужаснуться ценам, которые были изначально, но подпольная экономика сыграла злую шутку, и новые барыги (новые продавцы), чтобы получить приток покупателей к себе, стали снижать цены до разумных, тем самым начиная демпинговать, принуждая других игроков рынка со временем также снижать стоимость, так как вечно получить сверхприбыль нельзя. На данный момент, ценники по всем товарам стали вполне приятными, но учитывая постоянный рост аудитории и геометрически увеличивающиеся количество новых голов Гидры, цены претерпят в будущем корректировку, скорее всего рынок будет диктовать правила снижения ценников, для более интересной, конкуретной борьбы за клиентов. Для безопасности покупателей работает система авто-гаранта, как это выглядит? Любая сделка проходящая в магазине, автоматически "страхуется", в случае спорных ситуаций к беседе присоединяется администратор. Из полезных новинок - моментальные покупки, возможность быстро приобрести выбранный товар, без ожидания подтверждения транзакции в блокчейне, что весьма удобно, так как транзакция может подтверждаться и через сутки, оплата в btc и qiwi, как в старые добрые времена легко, пополнить баланс сайта можно даже через Сбербанк! Конечно доступен предзаказ, но в этом случае уже лучше обсуждать нюансы с продавцом. По словам администрации все торгаши проходят проверку, т.е. все представленные магазины 100% не мошенники, что само собой разумеется, так как бесплатно на маркете никого размещать не будут, кроме этого администрация контролирует качество работы магазинов веерными закупками. Внутри встроен мессенджер, аналог watsapp, у которого даже есть хештеги, ещё бы лайки приделали :), распределение на группы, приватные беседы и многое другое, нам кажется данный функционал гораздо более полезен магазинам для становления "корпоративной" сети. Более всего улыбает система технической поддержки, которая работает онлайн, в чат можно пригласить модератора, для разрешения практически любой спорной ситуации, даже в новый год отвечают очень быстро, мы проверяли 1 января, как только модератор принял решение, всем участникам беседы приходит об этом сообщение. =) Внутри магазина большой функционал, система самосжигающихся записок, отзывы покупателей о всех товарах, система рейтинга, десятибальная шкала оценки торговых площадок, возможность оставлять отзывы после каждой покупки, общий рейтинг продавцов, рейтинг покупателей, отображается количество успешных сделок совершённых продавцом и т.д. и т.п.Заключение.ОМГ онион в правду огромный исполин о трёх головах, движение которого крайне трудно предугадать, у данного сайта нет определённой аудитории, он охватывает все сферы теневого бизнеса, от продаж ПАВ до торговли документами и банковскими картами, географию и обьем продаж можно сравнить разве что с eBay, который известен каждому пользователю обычного интернета. Конечно такой огроменный драгмаркет в онионе ярко выделяется и сильно заметен, он манит разношерстную публику и, вполне вероятно, именно этот соблазн всего и вся может сыграть злую шутку, но ведь для этого у omg на каждое дело отдельная голова, отсечешь одну вырастут две, как известно, на текущий момент это лидер рынка, за что и занимает первую строчку нашего рейтинга. Что ещё сказать?Сейчас магазин Гидры очень популярен в сети, у неё даже появились зеркала, например, сайты предоставляют своим посетителям быстрый вход на сайт магазина. Проект ОМГ в онион расположен, обязательно проверяйте адрес ссылки куда заходите, вот 100% рабочая и настоящая ссылка.Что как то слишком грамотно получилось, такое даже у вас ощущение, что статья заказная, слишком всё хорошо не бывает, ложка дёгтя необходима, и ложка дёгтя заключается в том, что проект новый, крайне амбициозный, сайту менее двух лет, хоть он и развивается семимильными шагами, но что будет в будущем покажет только время.